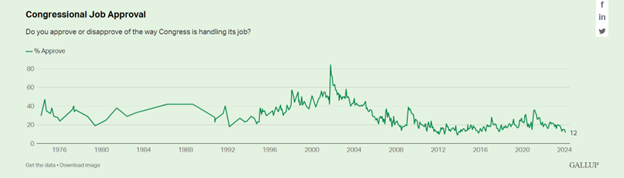

As we stand waist-deep in tax season, most Americans are scouring the earth looking for legal ways to reduce their tax bill or increase their refunds before they file their taxes. It seems like this scouring has become more voracious as time goes on and is probably correlated to the overwhelmingly negative U.S. Congressional Job Approval highlighted below.

This mindset most likely explains why tax planning is one of the most important things we work on for clients, while also being the conversation that keeps clients the most attentive.

One lever that retirees who need to take Required Minimum Distributions (RMDs) can pull to reduce their taxable income and give back to charity is the Qualified Charitable Distribution (QCD). Before the new SECURE Act 2.0 was passed into law in 2023, the QCD allowed a person aged 70.5 or older to send up to $100,000 from their IRA or tax-deferred investment account directly to a charity without it being subjected to ordinary income taxes. Here is a quick example of how QCDs were typically used before the new SECURE Act 2.0 was passed:

Example: An 80-year-old client had an RMD of $50,000 from her IRA and was charitably inclined. The client only needed $30,000 from her RMD to live on. The other $20,000 she would like to give to charity. If she were to just take the $50,000 directly and then send $20,000 from her bank account to charity, she would still be subjected to taxes on the full amount of the RMD of $50,000. She knows this and decides to instead withdraw $30,000 from her IRA and send $20,000 directly to charity in the form of a QCD. This means she would only be taxed on $30,000 of withdrawals, not the full $50,000. She also understands that while she can do a QCD up to $100,000, she would receive no further tax benefit from doing a QCD that is greater than $20,000.

The government is slow and deliberate when making beneficial tax changes for Americans. We saw this in action with the Alternative Minimum Tax (AMT) in the 1950s. An inflation adjustment to the AMT was not added until the Tax Cuts and Jobs Act (TCJA) in 2017, even though this caused many people to pay higher taxes than they otherwise would have needed to. Likewise, Congress has made the following updates to QCDs with SECURE Act 2.0 so that they are more beneficial to you:

- The QCD Limit has increased to $105,000 per person per year starting in 2024.

- The QCD Limit is now indexed for inflation. This will make sure that the QCD Limit will increase as the cost-of-living increases.

- There is a new one-time election that allows you to do a QCD up to $50,000 into a Charitable Trust such as a Charitable Remainder Unitrust (CRUT), Charitable Remainder Annuity Trust (CRAT), Charitable Lead Trust (CLT) or Charitable Gift Annuity (CGA) that you set up. This $50,000 limit does count against the total QCD limit for the year.

Keep in mind that the SECURE Act 2.0 also increases the starting RMD age to 73 for persons that were 73 on or after January 1, 2023, and will again increase to age 75 for persons turning 75 on or after January 1, 2033.

I’ve already given a basic example of how a QCD can lower a retiree’s taxable income while also gifting to charity. Let’s illustrate what QCD planning looks like in action.

Example:

Benevolent Betty is 70.5 years old and has an IRA of $1,000,000. She is charitably inclined, but not in good health and may pass away within the next 5 years. She wants to give to charity as much as possible during her lifetime so she can witness the fruits of her charitable gifts. She is married to Stingy Steve, who is also 70.5 years old, and he is in good health. He also has an IRA of $1,000,000. Though Steve hates that his wife wants to give to charity, he understands that it’s her money and she can do what she wants with it. He also wants to do whatever he legally can to pay as little tax as possible. Since they have differing goals, they decide to meet with an advisor to plan out a happy medium for them. They meet with an advisor to help them prioritize their financial planning goals. The advisor collects the following information and assumes the following from them during their initial conversation.

- Their IRAs earn 0% per year.

- Betty’s required beginning date for her RMD is at age 73.

- Steve’s required beginning date for his RMD is at age 73.

- The annual QCD Limits increase by a fixed amount of $5,000 per year. For example:

- $105,000 QCD Limit in 2024

- $110,000 QCD Limit in 2025

- $115,000 QCD Limit in 2026; and so on

- They are retired teachers and do not receive any Social Security benefits. They do receive pensions of $50,000 each that last for the remainder of both of their lives. The pensions do not have a cost-of-living adjustment.

- They live in Florida, so they are not subjected to state income taxes.

- They only need their pension income to live on.

- They take the standard deduction.

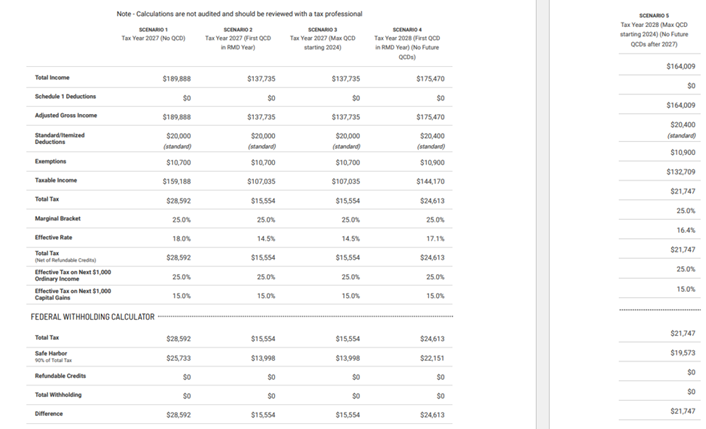

*Please note that all of the tax calculations are in the appendix of this article and any calculations can be replicated upon request.

Steve understands from the previous example that the QCD will only lower their taxable income if there are taxable distributions from their IRA to offset those QCDs. Therefore, he would rather start QCDs when they are 73. In the year they turn 73, their taxable income would be $15,554. If no QCD was done, their taxable income would be $28,592. Steve is ok with this result and agrees to Betty’s plan to start QCDs when she’s of RMD age. Betty tries to convince Steve that he can also do a QCD to lower their taxable income starting the year they turn 73, but to no avail. Steve does not want to do a QCD.

The advisor then tells both of them, “What if I can kill two birds with one stone and make you both happy?” Betty and Steve eagerly listen to what the advisor has to say next. The advisor tells them that since Betty wants to start gifting to charity now, she should start making QCDs now. Steve looks at the advisor quizzically, “Why? There’s no tax benefit.” The advisor responds, “There’s no tax benefit today, but there is over your lifetimes.” If Betty starts doing the max QCD each year now, her RMD will be lower when she gets to RMD age. This is because the RMD is tied to the balance of your account on 12/31 of the previous year. If there’s less money in the account, the RMD is less. If you were to do this instead, your taxes would not change since Betty is not taking any taxable distributions from her IRA. However, Betty is not in good health and may pass away in the next few years. Let’s assume that she passes away in 2028 as an example. We’ve agreed that Steve isn’t going to continue making QCDs after Betty passes away. If you only make one QCD in the year Betty is subjected to RMDs, the taxes due would be $24,613. If Betty was making QCDs from 2024-2027, the 2028 tax due would be $21,747. We’ve established that Steve’s goal is to pay as little tax as possible. We’ve also established that you both do not need your IRAs to live on. This is an example of when doing a QCD before your RMD age could meet your long-term financial goals.

Betty likes this idea but also wants to force Steve to gift at least $50,000 after she passes to make sure that her charitable legacy can continue for at least one year after she passes. The advisor mentions how making a one-time election for a $50,000 QCD to a Charitable Lead Trust (CLT) so that the charity will get at least $50,000 during the Trust’s term and Steve will get the remainder of the appreciated growth in the Trust after the Trust’s term expires. Even though this $50,000 QCD would count against the total QCD limit for that year, this is not a concern for Steve since he does not plan to do a QCD for more than the one-time $50,000 QCD Betty is making him do the year after she passes.

Conclusion:

As we’ve discussed, the newly expanded QCD rules are a benefit to those who are charitably inclined. However, please keep in mind that you should be charitably inclined first and looking to save taxes second. If you are in the 40% tax bracket, for example, we don’t want you to donate $1 just to save $0.40 on taxes. You’re still out $0.60 and you may be better off just paying the taxes. We want you to have the mindset of you want to donate a dollar and you also get the added benefit of saving $0.40 on taxes from doing a QCD.

If you are looking to pass your values onto others through charitable planning, give us a call at 714-282-1566 or email us at financialplanning@bfsg.com to get the conversation started. We’ll donate our time to you by offering you a complimentary consultation with our team of Certified Financial Planners professionals (CFP®s) who can help marry your charitable goals with holistic tax planning.

Appendix:

Sources:

- https://news.gallup.com/poll/1600/congress-public.aspx?version=print

- https://www.fidelitycharitable.org/articles/secure-act-2-0-retirement-provisions.html#:~:text=Increase%20in%20QCD%20limit%3A%20In,be%20annually%20indexed%20for%20inflation

- https://www.irs.gov/newsroom/401k-limit-increases-to-23000-for-2024-ira-limit-rises-to-7000

- https://www.forbes.com/sites/leonlabrecque/2023/03/30/secure-20s-new-rule-on-iras-and-charity-can-really-pay-off/?sh=23ab44e57278

- https://www.schwab.com/ira/ira-calculators/rmd

Disclosure: BFSG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to BFSG’s website or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please remember that different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy (including those undertaken or recommended by Company), will be profitable or equal any historical performance level(s). Please see important disclosure information here.