Pretend for a while that you are 40 years old and about to make an additional $10,000 per year with your new job that just started today, January 2, 2024. You are ecstatic about your future, and you go into your new HR manager’s office with all smiles ready to discuss details of your benefits package. You sit down and see that you have a 401(k) available with a Roth option and the ability to contribute to a Health Savings Account (HSA) if you are a part of a high-deductible health plan. You aren’t quite sure what’s right for you, so you sit down and talk to your HR manager and ask some questions. After your conversation, you start thinking about your old 401(k) at your old job that you haven’t looked at in years since you stopped contributing to it 10 years ago. Then you begin wondering if you should do anything with that account. It looks like there’s $30,000 in there and you are satisfied with that number because you are also a believer in the power of compounding interest over time. However, since that’s your only investment account, you want to make sure that you are making the best decisions when it comes to how much to contribute and how your account is allocated. You then sit back at your desk and finish your day’s work.

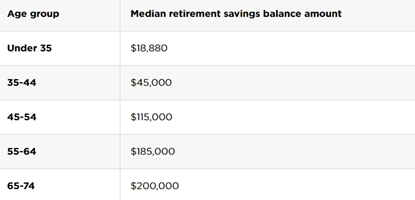

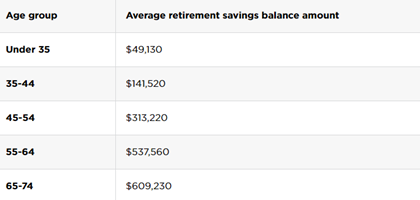

As you open the door to your home, you are greeted by your loving spouse with your beverage of choice. After you both sit down your spouse asks you how your day was, and you joyously recount the day’s events. Your 40-year-old spouse then asks about your old 401(k) and you both start thinking about your retirement. Your spouse is a self-employed artist who although they make a decent income, it isn’t enough to also be able to save for retirement. You then show them your old 401(k) statement and then your spouse exclaims, “$30,000? I read a recent report that the median retirement savings account balance per individual for someone who is 35-44 years old is $45,000. Looks like we’re behind the average.” Your demeanor quickly shifts to one of consternation and you ask to see the report. Your spouse shows you the following:

“See?” Your spouse remarks. “We’re behind the 8-ball when it comes to retirement savings. We should meet with a financial planner to prioritize our retirement savings and get things back on track.” You agree and sit down with a financial planner next week to help sort out your retirement savings plan.

“Thank you for meeting with me today.” The advisor states as they greet you and your spouse. “You’ve asked me a lot of different questions. I hear them and I will get to them. For now, I think it will be an important exercise to read over each of the account types available to you. We can back into which one(s) may be right for you and how much I would recommend saving to those investment accounts. To help guide our conversation, here is a pamphlet on the different retirement account types available to you.” You then take a few moments to read through the pamphlet.

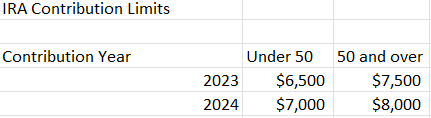

IRAs

An Individual Retirement Account (IRA) comes in two different types: the Traditional IRA and the Roth IRA. The 2023 and 2024 contribution limits are:

The deadline for making an IRA contribution is April 15th of the following year (i.e., a 2023 contribution can be made as late as April 15th, 2024).

Some of the features of the Traditional IRA are:

- Contributions may be tax-deductible.

- Earnings grow tax deferred.

- Withdrawals are taxed as ordinary income. Withdrawals may be subject to a 10% penalty if made before age 59.5.

- There are Required Minimum Distributions (RMDs) starting at either age 73 if you turn 73 on or after January 1, 2023, or age 75 if you turn 75 on or after January 1, 2033. The RMD is a percentage of the account that must be taken out each year. The purpose of the RMD is because you most likely received a tax deduction for making the initial contributions you are expected to eventually make a withdrawal from the account.

Some of the features of the Roth IRA are:

- Contributions are made with after-tax dollars and are not deductible.

- Earnings grow tax-free.

- If the following two prerequisites are met, withdrawals are tax-free:

- Prerequisite 1: The Roth IRA must have been open for at least 5 years.

- Prerequisite 2: Withdrawals are made after age 59.5.

- There are no Required Minimum Distributions (RMDs) since you did not receive a tax deduction for making the original contributions.

“Well, it sounds like a Traditional IRA may be the way to go. We get a tax deduction on the way in and that will be helpful since I just started the new job.” You hurriedly say as you jump to conclusions.

“Not so fast.”, says the financial planner. “We are in 2024 and that may be the way to go for the 2023 tax year. Your spouse also has a big art exhibition that they’re hosting next month. It could be their big break. 2023 could be the lowest tax year you’ll ever have. Maybe Roth IRA contributions may be the best for you. I would need to run the financial plan first to determine what would be best for you both. I’m also looking at the 2024 tax year and what may be the most beneficial to you going forward as well.”

You agree to continue reading the pamphlets provided by the financial planner.

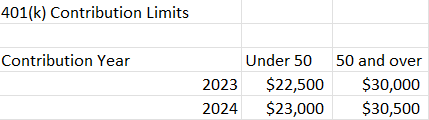

401(k) Plans

401(k) Plans come in three different types. The Traditional 401(k), Roth 401(k), and After-Tax 401(k). The 2023 and 2024 contribution limits are:

Contributions can only be made during the current calendar year. The Traditional 401(k) works taxwise very similar to how a Traditional IRA works. Likewise, a Roth 401(k) works taxwise, very similar to how a Roth IRA works.

An After-Tax 401(k) does not receive a tax deduction on the initial contributions but is still subjected to RMDs. Any investment gains when funds are withdrawn are subjected to ordinary income taxes.

You think to yourself that making Traditional 401(k) contributions may be the best way to go since the contributions are tax deductible and you believe that 2024 will be a higher tax year. You notice that the next section of the pamphlet has information on Health Savings Accounts (HSAs) and are curious to learn more about how they could benefit you and your spouse.

Health Savings Accounts

A Health Savings Account (HSA) is not specifically a retirement account, but a savings vehicle that can complement your retirement savings goals. To contribute to an HSA, you must be a part of a high-deductible health plan (HDHP) and is generally not recommended for persons with poor health or who have pre-existing conditions.

HSAs offer tax-free growth and tax-deductible contributions. If the funds are withdrawn for qualified medical expenses, the withdrawal is considered tax-free. If not, the withdrawal is subject to ordinary income taxes, and you would have a 20% early withdrawal penalty.

You think to yourself that since you were born with a pre-existing condition and need frequent doctor’s visits, an HSA may not be right for you. You do not want to worsen your insurance coverage to get a tax-deductible contribution towards a tax-advantaged account. You decide that you should just sign up for the Platinum PPO coverage your employer offers instead of signing up for a High Deductible Health Plan.

“Well thank you for providing these pamphlets to us. I believe that we should both make Roth IRA contributions for tax year 2023 and I should start making contributions to the Traditional 401(k) at my new employer.”

The financial planner agrees and wishes you and your spouse well. “I’ll let you know how the art exhibit goes next month.” Your spouse comments as you leave the financial planner’s office. The advisor responds, “Sounds great! Good luck and have a good day.”

A month goes by, and the financial planner gets a call from you and your spouse. You have the following conversation:

The Financial Planner: “How you are both doing? Did the art exhibit go well?”

Your spouse: “Yes! It went very well and that’s why we’re calling! The famous magnanimous art collector Baron von Moneybags came to my exhibition and decided to buy everything. He even commissioned me to work on a life-size sculpture of him next year for his vacation mansion in Monaco. He paid me $500,000 for everything and I’ll receive another $500,000 next year when the sculpture is finished. This is a huge break for us! There will be more heavy hitters in the art world knocking on my door asking to work on commissioned pieces. With that being said, what’s the best way for us to save for retirement?”

The Financial Planner: “First of all, congrats! This is huge for you both. Since you are a self-employed person, a SEP-IRA could allow you to contribute more than a Traditional IRA would allow. Plus, since you would receive an additional $500,000 of income in 2024 you most likely would not receive a tax deduction for making an IRA contribution regardless. I will send you the details on a SEP IRA via email.”

You and Your Spouse: “Sounds great! Thank you for your help.”

Later that evening, you and your spouse read the email from the Financial Planner about SEP-IRAs:

SEP-IRAs

From: The Financial Planner (financialplanning@bfsg.com)

Sent: Later that day

To: You and Your Spouse (example@email.com)

Subject: SEP-IRA

Congratulations Again!

Here are the details for the SEP-IRA.

A Simplified Employee Pension – Individual Retirement Account (SEP IRA) is designed for self-employed individuals that allow the employer to make tax-deductible contributions to a retirement account. The limit is greater than that of a Traditional IRA. The contribution limit in 2023 is $66,0000 or up to 25% of business earnings or compensation, whichever is less. The SEP-IRA contribution limit for 2024 is $69,000. Notice how there is no catch-up provision for persons age 50 and older.

In your case, you would be able to contribute the full contribution limit for 2024 since you mentioned that your net profit this year will be about $450,000. Since you are going to be in a much higher tax bracket this year and for the foreseeable future, a SEP IRA contribution would help reduce your tax liability in 2024. Your income in 2023 was much less and I still believe that you should make a Roth IRA contribution for 2023 instead of making a SEP-IRA contribution for 2023.

Take your time to think about what you would like to do going forward. I can send you any additional information about SEP-IRAs if that would help you in your decision-making process.

All the best,

The Financial Planner

Your spouse mentions that doing a SEP-IRA for 2024 would most likely be the best course of action since it would mitigate your household’s tax liability in 2024 and help you both catch up with your retirement savings relative to your peers. This exercise also taught you both that retirement planning is not a “set it and forget it” game. You both agree it would be best to meet with your Financial Planner at least annually to discuss what the right retirement savings vehicles are for your household.

Summary:

Thank you for staying with me throughout that thought experiment. I doubt that your situation is exactly like the one detailed in this article. If you were looking at those retirement savings statistics earlier in the article and thinking that you’re behind, remember that it’s never too early to begin saving toward the retirement that you want. Also, please always try your best to not compare yourself to other people. Your financial journey is your own and their financial journey is their own. As I conclude, maybe this article has you asking yourself questions like:

- “What are the right retirement account types for me?

- “How much should I contribute?”

- “Does saving towards retirement conflict with any of my other financial goals?”

- “Will I have enough money saved for retirement so that I can live out the lifestyle I want to in retirement?”

These questions and more can be answered by meeting with one of our Certified Financial Planner professionals (CFP®s) who will help you prioritize your retirement and financial planning goals. Email us at financialplanning@bfsg.com or call us at 714-282-1566 to get the conversation started.

Sources:

Disclosure: BFSG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to BFSG’s website or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please remember that different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy (including those undertaken or recommended by Company), will be profitable or equal any historical performance level(s). Please see important disclosure information here.