Fiduciary Governance

Navigating Complex Landscapes.

BFSG has decades of experience helping plan sponsors build strong fiduciary governance structures to oversee their retirement plans. The retirement plan landscape is complex and dynamic, and having documented processes will help fiduciaries provide their employees with an effective retirement planning tool, while mitigating liability. We believe that successful retirement plan outcomes come from careful plan sponsors making informed and prudent decisions about their plan.

Our fiduciary consulting services are designed to keep our clients updated with the ever-changing environment and make sure they are informed every step of the way.

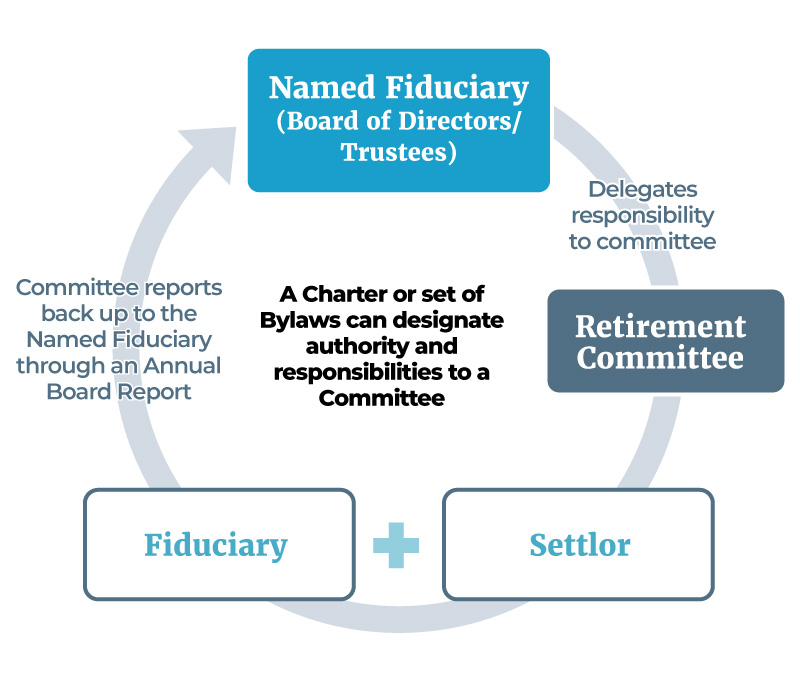

Committee Charter

Rely on us to help formalize the delegation of fiduciary and administrative duties while providing protection for the “Named Fiduciary” of the retirement plan and the committee members.

Fiduciary Education

Be assured your committee members will stay informed about their roles and responsibilities associated with being a plan fiduciary.

Meeting Agendas/Minutes

Developing strategic agendas helps committee members meet their fiduciary obligations, while driving the best possible outcomes for your employees, and we’ll document.

Online Document Storage

Let us store all necessary fiduciary documents so you can be prepared for audit season.

Questions and Answers

What is a Committee Charter?

All ERISA-covered plans are required to have a Plan Administrator and a Named Fiduciary. The employer usually designates a benefits committee to serve this function. If the employer does not appoint a Plan Administrator, then the employer shall retain full liability over the retirement plan.

Who is a Fiduciary?

A fiduciary is someone legally obligated to act solely on behalf of the person(s) he or she represents.

Under ERISA, there are two types of fiduciaries:

- Named Fiduciary: Each plan document is required to list at least one person who is responsible for the plan. In many cases, it is the Board of Directors.

- Functional Fiduciary: ERISA stresses the importance of function over title. ERISA 3(21)(A) provides that the following people are a fiduciaries:

- Anyone with discretionary authority over plan assets

- Anyone who exercises control over plan assets

- Anyone who gives investment advice for compensation

What is the difference between settlor and fiduciary functions?

- Settlor Function Committee (administrative) – Plan design is normally established at the corporate level and is not a fiduciary function. However, the Settlor Committee may be involved in making Plan design decisions. In those actions, the Committee is not acting in a fiduciary capacity.

- Establishment of a plan

- Determination of covered employees

- Determining a match amount

- Setting a vesting schedule

- Amending a plan (non-required amendments)

- Terminating a plan

- Fiduciary Function Committee (investment) – Fiduciary functions require the Committee to exercise the care of a prudent person who is familiar with Plan issues in the best interest of the participants.

- Selection of Investment Manager(s)

- Selection of Service Provider(s)

- Filing Form 5500

- Utilizing Plan Assets

- Amending a plan (required amendments)

What type of Fiduciary Education does BFSG provide?

BFSG’s fiduciary education services include:

- Regular fiduciary training and best practices in fiduciary governance

- Legislative and regulatory updates

- Committee member onboarding sessions

- A 30-minute fiduciary training video, which may be viewed here.

What are the primary Fiduciary Standards of Care?

ERISA 404(a)(1) places the following standards on fiduciary:

Duty of Loyalty: Duties shall be discharged with respect to a plan solely in the interest of participants and beneficiaries.

Exclusive Benefit Rule: Duties shall be discharged with the exclusive purpose of providing benefits to paricipants and their beneficiaries and defray reasonable expenses of administering the plan.

Duty of Care “Prudent Expert Rule”: Duties shall be discharged with “the care, skill, prudence, and diligence under the circumstances then prevailing that a prudent man acting in a like capacity and familiar with such matters would use in the conduct of an enterprise of a like character and with like aims.”

Duty to Diversify: Plan assets shall be diversified to minimize the risk of loss.

Duty of Obedience: The Plan shall be administered in accordance with the Plan Document.

Paying Too Much? Don’t.

Complimentary Fee Analysis and Investment Review

All we need is a copy of your 408(b)(2) Plan Sponsor Fee Disclosure and we will provide a report which benchmarks fees and investment performance against industry averages.