By: Tina Schackman, CFA®, Senior Retirement Plan Consultant

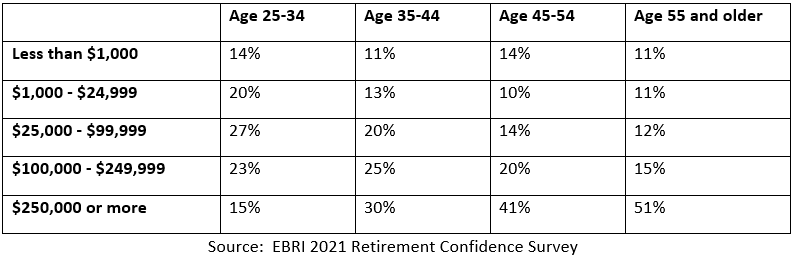

According to a 2021 Retirement Confidence Survey by the Employee Benefit Research Institute (EBRI), U.S. workers preparing for retirement vary by age but there are signs that savings habits are starting to take place earlier than previously reported. In fact, 48% of respondents between the ages of 25 and 34 reported having savings of $100,000 or more.

Starting to save early is one of the easiest ways to accumulate savings for retirement.

Of the 31% of respondents that stated they made changes to their retirement plan since January 1, 2020, more than half increased the amount they contribute. A workplace retirement plan, such as a 401(k) or 403(b) plan, can help build retirement savings through tax-deferred savings and the potential for your company to match your contributions to the plan. Check out our recent Summer Webinar Series “Retirement Accounts: Traditional vs. Roth” for typical ways to save for retirement.

What’s getting in the way of reaching savings goals? Debt is the #1 reason, and it weighs heavier on workers who experienced loss of income or a job. In fact, 70% feel debt is negatively impacting their ability to save for emergencies. Establishing and sticking to a budget can be a great way to get your finances under control and find more ways to save. We recommend you watch the replay of “Connecting the Dots to Your Financial Future (Part 1)” to learn some budgeting tips and debt payment strategies.

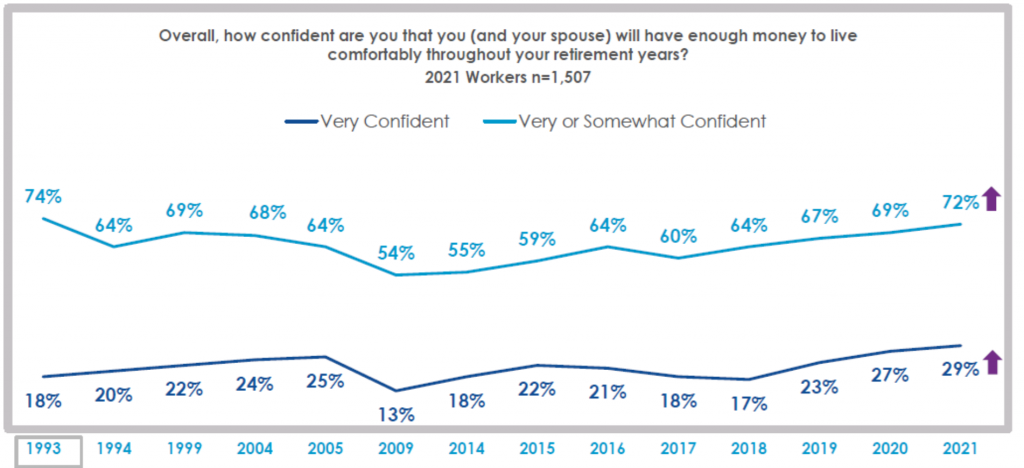

Confidence is key! The majority of U.S. workers remain confident in their ability to live comfortably in retirement.

We wanted to provide a few tips to start creating healthy savings habits:

- Pay yourself first and start early.

- Don’t take on more debt than you can afford.

- Pay down credit cards as soon as you can.

- Understand your employer’s retirement plan.

- Create a budget and track expenses.

- Set financial goals and have a plan (start with a small goal that can be easily attained)

Contact BFSG if you’d like to learn more about developing your personal financial plan at financialplanning@bfsg.com.

Prepared by Broadridge Advisor Solutions. Copyright 2021. Edited by BFSG, LLC.

Disclosure: BFSG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to BFSG’s web site or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please see important disclosure information here.