By: Henry VanBuskirk, CFP®, Wealth Manager

(This is part 2 of a four-part estate planning series)

In our previous installment in this series, we discussed what Estate and Gift Taxes are and why they exist. In this installment, we will discuss strategies that can help reduce your overall income tax burden from the estate tax.

The most logical way to lower your taxable estate is to get assets out of your estate while you are alive so that they aren’t there when you pass for estate tax purposes. As mentioned in the previous blog, you can’t just gift assets away since you would be lowering your lifetime federal estate tax exemption by the amount you gifted over the annual exclusion of $16,000 per year (or $32,000 per year for married couples) and call it an effective strategy. Some strategies allow you to potentially get millions out of your estate and avoid future estate and gift tax liability, all while maintaining your lifetime federal estate tax exemption. If you have concerns regarding how these strategies could affect certain estate and gift planning transactions in which you intend to engage or have previously engaged, please contact your tax advisor and estate planning attorney to further discuss your estate and gift planning inquiries. Our firm is happy to work with you and your estate planning attorney on your unique situation and we can work together to help you achieve your estate planning goals.

Two strategies that I would like to discuss today are the ILIT (Irrevocable Life Insurance Trust) and the QPRT (Qualified Personal Residence Trust).

Irrevocable Life Insurance Trust

The Irrevocable Life Insurance Trust (ILIT) is where you set up a trust that will own and be the beneficiary of a life insurance policy on the grantor (the person or persons that created this trust). The trustee(s) (the person or persons that are given the legal authority to administer the trust as written) can be anyone except the grantor. An ILIT is irrevocable, meaning it cannot be changed after it has been executed. The ILIT allows the life insurance policy to be removed from the estate and the death benefit to be paid out to the beneficiaries directly, avoiding estate taxes. One important thing to note, is that the grantors that are insured by the life insurance policy must live at least 3 years past the funding of the ILIT, otherwise the life insurance policy will still be part of the estate. Therefore, many life insurance policies that are in a married couple’s ILIT are structured as a second-to-die policy, which means that the death benefit would only pay out upon the surviving spouse’s passing. Many life insurance companies that offer second-to-die policies also include a rider (an additional feature that is added to the policy, normally with an additional cost) to pay out an additional death benefit in the first three years of the policy. This is so that if the policy were to be included in the estate, the policy would also pay off the estate taxes due for having it be included in the estate if the grantor or grantors pass during the first three years of the ILIT.

ILIT example: The Jones Family has an estate of $50,000,000 and they are concerned about their estate tax liability that their heirs would have to deal with at the time of their passing. Therefore, Mr. and Mrs. Jones set up an ILIT and purchase a life insurance policy for $8 million and start paying annual premiums on the policy. Mr. Jones passes away 3 years later, while Mrs. Jones passes away 6 years later. The policy would pay out the death benefit of $8,000,000 after Mrs. Jones’ passing directly to Mr. and Mrs. Jones’ heirs tax-free. Their heirs would also inherit an estate of $42,000,000 that would be subject to the estate tax. If an ILIT was not used, the heirs would instead inherit an estate of $50,000,000 subject to estate taxes.

Qualified Personal Residence Trust

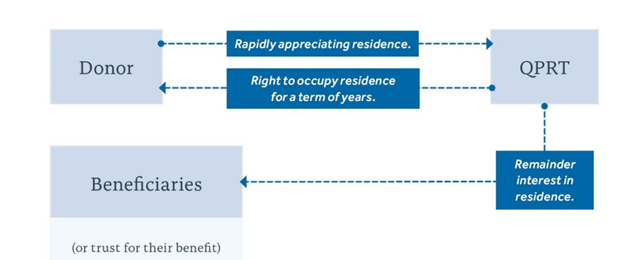

A Qualified Personal Residence Trust (QPRT) is a type of irrevocable trust that allows you to move up to two personal residences (a primary residence and vacation home or secondary residence, or a fractional interest in each) out of your estate. The catch is that you would need to gift the assets into the QPRT to the named beneficiary(ies) at the end of the time frame established by the QPRT (usually 10 years). If the QPRT is properly structured and the time constraint is met, then all appreciation on the real estate from the date of the transfer to the QPRT is considered tax-free and the grantors of the QPRT will pay gift tax on the original value of the property at the start of the QPRT.

Basics of a QPRT

QPRT example: Mr. and Mrs. Smith have an estate worth $35 million and have a primary residence worth $3 million, a vacation home worth $2 million, and a secondary residence worth $1 million. The Smiths set up a QPRT for a term of 10 years and have their kids as the beneficiaries of the QPRT. This would allow the Smiths to continue to live in and use the properties for 10 years but would give up ownership of the property after the 10 years are up. They then gift their primary residence and vacation home to the QPRT. After 10 years the primary residence is worth $6 million, and the vacation home is worth $4 million. These assets are out of the estate and their estate is now worth $30,000,000. The Smiths pay a gift tax on $5,000,000 (the gift tax is on the original value of the property at the start of the QPRT). The Smiths instead of getting their checkbook out and paying the gift tax, decide to instead utilize their lifetime federal estate tax exemption, combined with the $32,000 gift splitting election, which would lower their federal estate tax exemption from $24,120,000 to $19,152,000.

For the next installment, I would like to discuss how you can minimize your estate tax to have your heirs enjoy the appreciated value of your asset, while being able to have some benefits of your own during your lifetime.

Disclosure: BFSG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to BFSG’s website or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please remember that different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy (including those undertaken or recommended by Company), will be profitable or equal any historical performance level(s). Please see important disclosure information here.