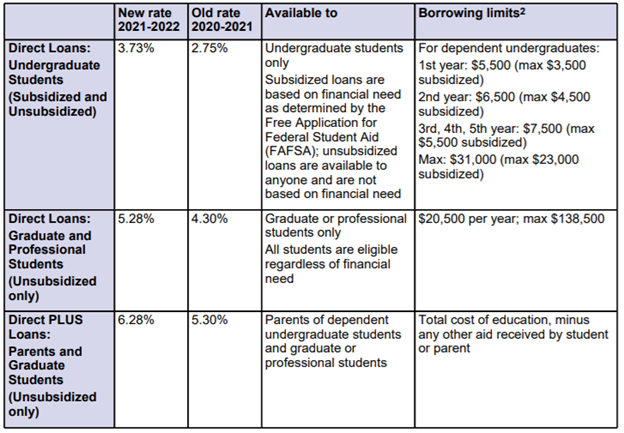

After two years of decreases, interest rates on federal student loans are set to increase almost a full percentage point for the 2021-2022 school year.1

The interest rates on federal student loans are reset each year after the May auction of the 10-year Treasury note. The rates apply to new federal student loans issued on or after July 1, 2021, through June 30, 2022. The interest rate is fixed for the life of the loan.

Subsidized vs. unsubsidized: what’s the difference? With subsidized loans, the federal government pays the interest that accrues while the borrower is in school, during the six-month grace period after graduation, and during any loan deferment periods. With unsubsidized loans, the borrower is responsible for paying the interest during these periods. Only undergraduate students are eligible for subsidized loans, and eligibility is based on demonstrated financial need.

In case you missed it, check out our A Definitive Guide to Education Planning webinar where we outline your options with student loans.

1) The New York Times, May 28, 2021

2) U.S. Department of Education, 2021

Prepared by Broadridge Advisor Solutions. Copyright 2021. Edited by BFSG, LLC.

Disclosure: BFSG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to BFSG’s web site or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please see important disclosure information here.