All those benefits of personal growth, expanded horizons, and increased lifetime earning power comes at a price, a price that increases every year, but we believe a college degree is worth it.

A college education is expensive. For decades, college costs have outpaced annual inflation, and this trend is expected to continue. According to the College Board’s annual Trends in College Pricing Report, for the 2020-2021 academic year, the average cost of attendance at a four-year public college for in-state students is $26,820, the average cost of attendance at a four-year public college for out-of-state students is $43,280, and the average cost of attendance at a four-year private college is $54,880. Many private colleges cost substantially more. The total cost of attendance includes direct billed costs for tuition, fees, room, and board, plus a sum for books, personal expenses, and transportation.

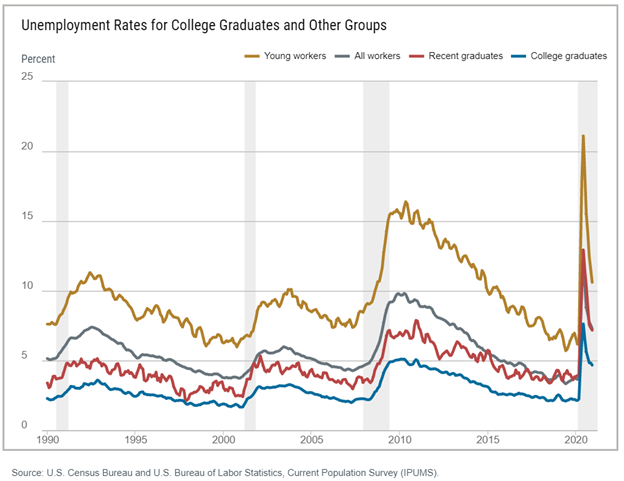

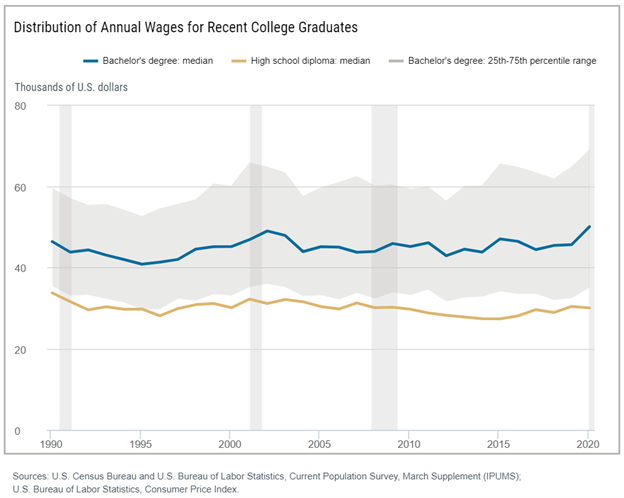

However, a college degree typically provides job security and increased lifetime earning power (see the charts below).1

Keep in mind though, there are different labor market and wage outcomes by the chosen college major. Click here to see those outcomes. This should be an important consideration when helping your child choose which school to attend.

Why You Should Start Saving Early

Next to buying a home, a college education is the largest expenditure most parents will ever make (and perhaps the biggest expenditure when more than one child is in the family picture).

The earlier in the process you become informed about the potential costs and your saving options, the greater chance you will start saving. And the more money you save now, the less money you or your child will need to borrow later.

How much you need to save obviously depends on the estimated cost of college at the time your child is ready to attend. Often, these numbers are staggering. Don’t be discouraged if you can save only a minimal amount at first. The key is to start saving early and consistently and to add to it whenever you can from raises, bonuses, or unexpected gifts. In addition, parents generally supplement their savings at college time with a combination of personal loans, financial aid (student loans, grants, scholarships, and work-study), and tax credits to cover college costs.

After you determine how much you can save each month, you will need to choose one or more college-saving options. There are many possibilities to pay for college — watch our webinar “A Definitive Guide for education Planning” to understand your options with student loans and learn about the best ways to save for college and maximize student aid.

It is never too late to start planning for college and we are here to help you put together a plan.

Prepared by Broadridge Investor Communication Solutions, Inc. Copyright 2021. Edited by BFSG.

- Federal Reserve Bank of New York, The Labor Market for Recent College Graduates, February 12, 2021

Disclosure: BFSG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to BFSG’s web site or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please see important disclosure information here.