By: Henry VanBuskirk, CFP®, Wealth Manager

The current rule states that you must take your first Required Minimum Distribution (RMD) by April 1st of the year after you reach 72 and annually thereafter by December 31st of each year. When the SECURE Act became law on December 20, 2019, the RMD age was pushed back from age 70.5 to age 72.

Plans affected by RMD rules are: 401(k) plans, 403(b) Plans, 457 Plans, Traditional IRAs, SEP IRAs, SIMPLE IRAs, Inherited IRAs and Inherited Roth IRAs. Defined Benefit and Cash Balance plans satisfy their RMDs by starting monthly benefit payments (or a lump sum distribution) at the participant’s required beginning date.

If you’re still employed by the plan sponsor of a 401(k) and are not considered to be a more than 5% owner, your plan may allow you to delay RMDs until you retire. The delay in starting RMDs does not extend to owners of traditional IRAs, Simplified Employee Pensions (SEPs), Savings Incentive Match Plans for Employees (SIMPLEs) and SARSEP IRA plans.

The RMD value is calculated based on the qualified investment account’s value on December 31st of the prior year and is based on standardized IRS guidelines (i.e., the RMD for 2022 is based on the value of the account on 12/31/2021). The prior year’s year-end balance is divided by a life expectancy factor issued by the IRS.

If you have more than one IRA, you must calculate the RMD for each IRA separately each year. However, you may aggregate your RMD amounts for all your IRAs and withdraw the total from one IRA or a portion from each of your IRAs. You do not have to take a separate RMD from each IRA. If you have more than one defined contribution plan, you must calculate and satisfy your RMDs separately for each plan and withdraw that amount from that plan (Exception: If you have more than one 403(b) tax-sheltered annuity account, you can total the RMDs and then take them from any one (or more) of the tax-sheltered annuities).

For inherited IRAs and inherited Roth IRAs, if the account was inherited before the SECURE Act was passed, you can take RMDs over your life expectancy. If you inherited the account after the SECURE Act was passed, there are no required annual distributions, but the account must be depleted within 10 years of the account owner’s death unless the beneficiary is a spouse, a disabled or chronically ill individual, or a minor child until they reach the age of majority.

Now let’s take a look at the options available to you for your IRA, 401(k), or another qualified investment account subject to RMD rules.

Option 1 – Take your RMD.

This is the most straightforward option. You can take your RMD (or a greater amount if needed), withhold the appropriate federal and state taxes from the distribution, and use the net distribution as needed. If this is your first year taking your RMD, you can take two RMDs in the first required year. This is because the rules say by April 1st following the year you turn 72. Therefore, you could take your 2022 RMD on February 15, 2023, and your 2023 RMD on June 30, 2023. Doing this would allow you to delay the first year’s RMD for tax purposes for only the first year and means that the 2022 RMD wouldn’t affect your 2022 tax return. However, Uncle Sam will eventually get his recompense and your 2023 tax return would reflect your 2022 RMD and 2023 RMD with this strategy. Note that RMDs are taxed at ordinary income rates.

Option 2 – Don’t take your RMD.

Please don’t go with this option. The IRS has a very steep penalty for those who don’t take their RMD. The IRS penalty is 50% of the amount not taken on time. In general, even if you don’t need the money. You really should take it. As you will see later, there are many options available to you even if you don’t need the money.

Option 3 – Take your RMD and invest those proceeds into a non-qualified investment account.

With this option, you would take the RMD as normal and withhold federal and state taxes and invest the net distribution into a non-qualified (taxable) investment account. The non-qualified account could be used for general savings to be used during your lifetime, an inheritance to gift to your beneficiaries after your death, or to help save for a future unexpected expense like a long-term care need.

Option 4 – Qualified Longevity Annuity Contract (QLAC).

A QLAC is a strategy where you put in the lesser of 25% of the total value of all your qualified investment accounts or $145,000. A QLAC allows you to fund an annuity contract as early as age 65 and delay income received from the annuity until age 85. The QLAC itself does not count towards the RMD calculation, but the income received from QLAC is treated as ordinary income. This sounds like the slam dunk option, right? Wrong. The answer is it depends on your unique situation (like most answers in financial planning). Yes, a QLAC would help lower the tax bill during the years you defer taking income from the QLAC, at the cost of less net money in your pocket during the early years of your retirement and annuity payments that do not generally have a cost-of-living adjustment tied to them that would increase your tax bill because you still have RMDs on top of the QLAC payments. A QLAC is generally also an irrevocable decision. We would be happy to discuss the pros and cons of purchasing a QLAC if you have further questions.

Option 5 – Qualified Charitable Distribution (QCD).

For the altruist (who also likes not paying taxes), a QCD is an option. If there is a charity (a 501(c)(3) organization) that you feel passionate about, you can donate up to $100,000 per year (as of tax year 2022) directly from your qualified investment account to that charity tax-free. This helps you avoid the distribution being included in your taxable income and is especially valuable for those who don’t typically itemize on their tax returns. The key word is “directly”, as if you physically take the RMD check and then turn around and write a check to that charity, that does not count. For those over age 70.5, QCDs can be used before you are required to take your RMD at age 72. We can work with you to make sure that your QCD is done correctly.

Option 6 – College Planning.

Maybe you have a sizable estate and are concerned about making sure your grandchildren can attend college. With this option, you can put the net RMD funds into a 529 Plan that would grow tax-free and withdrawals can be tax-free if the funds withdrawn from a 529 Plan are used for qualified educational expenses (i.e., tuition, books, room and board, etc.). Contributions to this investment account may even be tax-deductible in your state. Also, since this is considered a gift, you are lowering the size of your taxable estate, which could help your heirs at the time of your passing. Normally you are only allowed to gift $16,000 per year (or $32,000 per year if you elect gift splitting with your spouse) per beneficiary. But with a 529 plan, you can gift 5 years’ worth of gifts in only one year (“superfunding”). This means that you could potentially gift $80,000 per beneficiary for a single tax filer or $160,000 per beneficiary for a married couple into the 529 plan and lower your taxable estate by that amount. There are a few moving parts in this example, including possibly filing a gift tax return, so we would need to work with you and possibly your accountant and estate planning attorney to make sure this would all go according to plan.

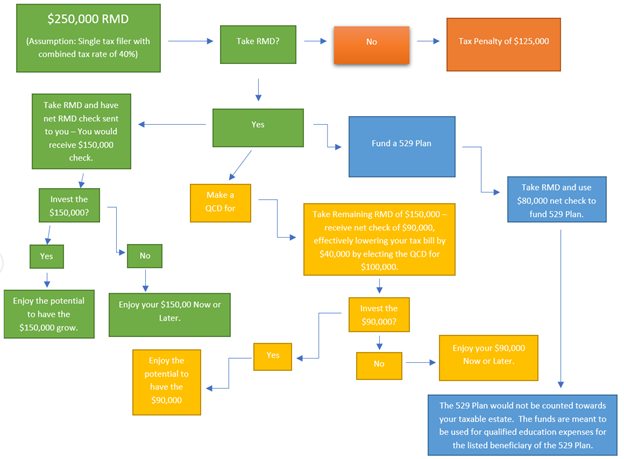

Now that we have an idea of the different options available to you, we would like to illustrate examples of how some of these options can be used in a real-world setting.

*If you have a QLAC, the calculations could differ, but the general idea of the flowchart would still be the same.

The goal of this article was to illustrate that there are many different options available to you (including ones not illustrated in this article). Also, check out this 2-minute BFSG Short which gives a high-level overview of the most important things to know about RMDs. Our team is available to discuss these concepts with you in further depth if you have any other questions and to evaluate what option would be best for your unique situation.

Disclosure: BFSG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to BFSG’s website or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please remember that different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy (including those undertaken or recommended by Company), will be profitable or equal any historical performance level(s). Please see important disclosure information here.