By: Robert Verdugo, CMFC®, APMA®, Financial Analyst

As the Federal Reserve (the Fed) is poised to start raising rates today, and with the S&P 500 (1) down over 10% off its highs, is it time to declare the bull market dead? History would say no – in fact, a resounding no. Jess Menton’s article in Bloomberg, titled “What Happens to Stocks When the Fed Hikes: A Historical Guide”, does a quick dive into the historical performance of the S&P 500 after the first initial rate hike by the Fed.(2)

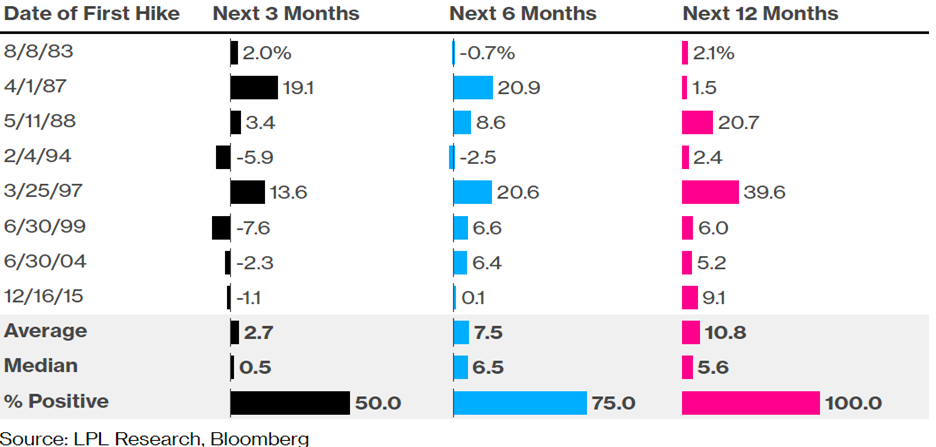

The previous 8 rate hike cycles all ended with the S&P 500 higher 12 months later, 50% of those instances had the market up after just three months.

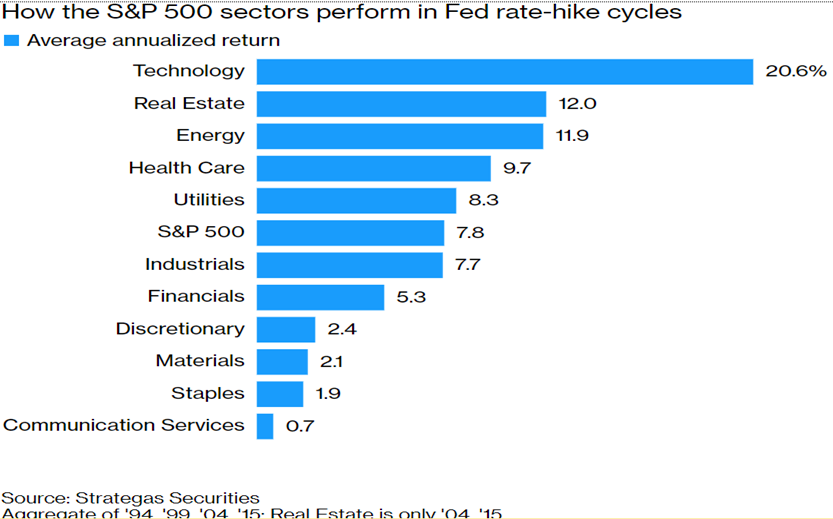

The article also highlights the different sectors and their relative performance after the rate hike begins:

It makes sense that the technology sector would be the leader out of the gate, considering it’s typically the sector getting battered prior to the actual rates increase.

While this does argue the case that the bull run may still be intact, could there be a stumbling block (or two) that could make this time different? Absolutely, and it could very well be the reason why you’re gritting your teeth at the pump. According to the article, recent oil price surges may create a problem for the Fed. In the past, oil shocks have “… preceded economic downturns in the mid-1970s, early 1980s and early 1990s. But other recessions, like after 9/11 in 2001 and the global financial crisis in 2008, weren’t directly caused by a sharp rise in crude prices.” A second large reason for more volatility will be midterm elections this year, as they traditionally cause a ruckus for the markets in the preceding months before the elections.

The market is said to be forward looking, and it requires a very accommodating Federal Reserve to signal its moves. While it’s never been a perfect marriage, the stock market does its best to price in future actions in the current market. Is that what is happening during this correction? Only to start its rise after the hikes begins? Nobody knows for certain. What one can safely assume, however, is that more volatility is in store in the near future. Let’s also hope for a less stressful times at the gas station too, that would be nice.

- The S&P 500 is designed to be a leading indicator of U.S. equities and is commonly used as a proxy for the U.S. stock market.

- Please remember that past performance may not be indicative of future results.

Disclosure: BFSG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to BFSG’s website or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please remember that different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy (including those undertaken or recommended by Company), will be profitable or equal any historical performance level(s). Please see important disclosure information here.