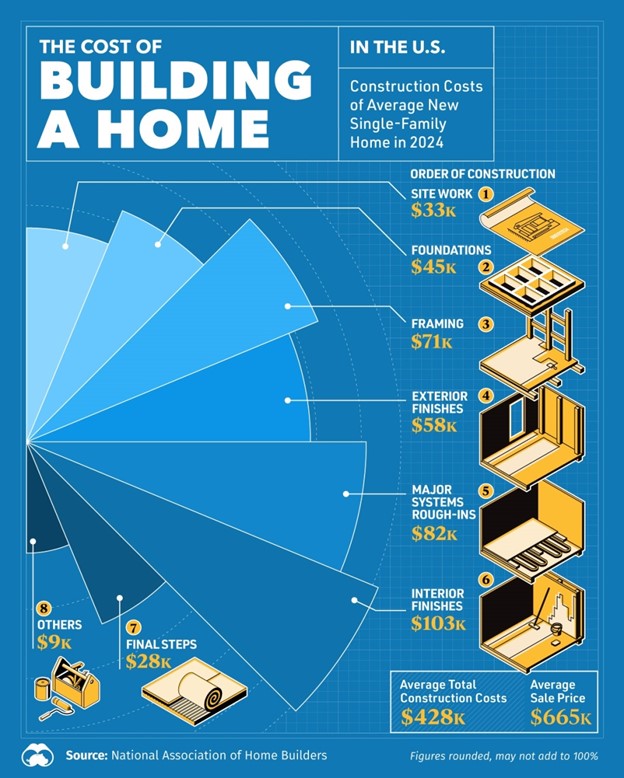

Building a new home is a major undertaking that involves many moving parts, from laying the initial foundation to giving the house its final touches. In 2024, the average cost of constructing a new home was $428,215, the highest level recorded by the National Association of Home Builders (NAHB) since it began its annual cost surveys in 1998. This equates to around $162 per square foot of finished floor space, with the average home spanning 2,647 square feet in 2024.

Here’s a breakdown of what work and materials are included in each stage of the building process:

- Site work — Building permit fees, impact fee, water and sewer fees, inspections, architecture, engineering; share of construction cost: 7.6%

- Foundations — Excavation, foundation, concrete, retaining walls, backfill; share of construction cost: 10.4%

- Framing — Framing (including roof), trusses, sheathing, general metal and steel; share of construction cost: 16.6%

- Exterior finishes — Exterior wall finish, roofing, windows and doors; share of construction cost: 13.4%

- Major systems rough-ins — Plumbing and electrical (except fixtures), HVAC; share of construction cost: 19.2%

- Interior finishes — Insulation, drywall, interior trims, doors, mirrors, painting, lighting, cabinets and countertops, appliances, flooring, plumbing fixtures, fireplace; share of construction cost: 24.1%

- Final steps — Landscaping, outdoor structures (deck, patio, porches), driveway, clean up; share of construction cost: 6.5%

- Other — share of construction cost: 2.1%

Figures do not add to 100% due to rounding.

The U.S. Housing Market in 2025

The outlook for U.S. residential construction in 2025 looks constrained due to various factors. According to the NAHB, builder confidence remains relatively low due to higher material costs, with tariffs by the Trump administration threatening further cost increases.

Meanwhile, home construction starts have been relatively stable since 2021, but the number of new homes available for sale is at the highest level since 2010, suggesting a lack of demand for new housing amid high borrowing costs and affordability constraints. As affordability concerns persist, some builders are offering price reductions and sales incentives (such as mortgage buydowns) to attract new buyers.

Nationally, existing home sales are down 2.4% through April and sellers cut prices on nearly one in five listings last month, according to Realtor.com. Listings are higher than before the pandemic in nine states and that’s spurring price reductions. In real estate, “location, location, location” are the crucial factors in determining what such a pullback looks like.

Buyers are starting to gain the advantage in some parts of the US. A recession could bring the opportunity buyers have been waiting for. A decline in mortgage rates would further improve the math.

Sources:

- Graphic created by Visual Capitalist.

- The data is based on a survey of 4,000 U.S. home builders by the National Association of Home Builders (NAHB).

- Mishkin, S. (2025, May 26). Home buyers stay on the sidelines as listings rise. Barron’s.

Prepared by Broadridge. Edited by BFSG. Copyright 2025.

Disclosure: BFSG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to BFSG’s website or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Forecasts are based on current conditions, are subject to change, and may not come to pass. Please remember that different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy (including those undertaken or recommended by BFSG), will be profitable or equal any historical performance level(s). Please see important disclosure information here.