Wall Street can often feel like a popularity contest. Every year the market has a darling stock or stocks that everyone agrees to be the flavor of the month (or year, or decade) and the stock(s) will dramatically rise regardless of fundamentals or other factors. Asset bubbles inflating and bursting are a recurring phenomenon in world economic history – the British South Sea Company bubble (1720), the British railway mania (1844-1846), the Nifty-Fifty bubble (1960’s), the gold bubble (1970’s), the Japanese stock market bubble (1980’s), the Dot Com bubble (1990’s), the housing bubble (2000’s). More recently we are seeing this same trend with some high growth stocks. While it is always a fun ride on the hype train it is not uncommon for these stocks to come crashing back to earth.

Let’s take a quick look at some interesting charts regarding Tesla (TSLA), a recent darling stock, highlighting some of the dangers of riding the hype train too long. Currently, Tesla is worth more than almost all the other car manufacturers combined as we can see in the chart below showing their market caps.

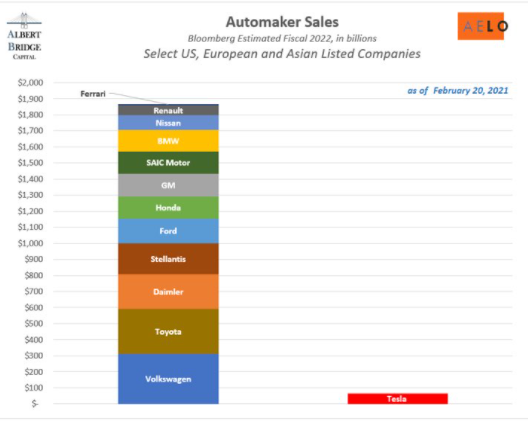

Looking at current auto sales we see the exact opposite story. Tesla accounts for a small portion of all cars sold. The next chart shows that the rest of the industry accounts for the vast majority of sales but Tesla is just a pittance in comparison.

These charts are not to say that Tesla is a bad investment (a surge in regulatory-credit revenue has been a major factor in Tesla’s streak of quarterly profits that has sent shares soaring) or that it can’t become a dominant auto manufacturer. All they suggest is that the stock price may have gotten ahead of itself and this could leave some investors in a bad position if the stock tumbles. As with any investment, it is important to understand the merits and risks of the investment. We have seen too many investors get wrapped up in the hype train of Wall Street and they often end up getting burned.

Disclosure: Investing involves risks, including the potential for loss of principal. There is no guarantee that any investment or strategy will be successful or meet its objectives. The investments discussed may not be suitable for all investors. Investments and strategies outlined in this blog are not provided as personalized investment advice and should be discussed with an advisor prior to implementation.

BFSG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to BFSG’s website or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please see important disclosure information here.