Parenthood can be both wonderfully rewarding and frighteningly challenging. Children give gifts only a parent can understand — from sticky-finger hugs to heartfelt pleas to tag along on Saturday morning errands. As you raise them and make sure they get a good, strong start in life, one thing is obvious — children are expensive! Fortunately, you can take steps to prepare for the financial challenges you face.

How expensive is raising a child?

The United States Department of Agriculture estimates that the average nationwide cost of raising one child in a two-parent family from cradle to college entrance at age 18 ranges from $174,690 to $372,210, depending on income.1

Reassess your budget

As your family grows, you may need to make changes to your budget. Many living expenses may increase, including grocery, clothing, transportation, healthcare, insurance, and housing costs. You may also need to account for new expenses, such as childcare, or adjust your budget to account for a decrease in your income if you decide to become a stay-at-home parent. Your budget may also need to expand to include new financial goals, such as saving for college or buying a home. Making sure that your budget reflects your new financial priorities can help you stay on track.

Review your life insurance coverage

What would happen to your children if something happened to you? Life insurance is an effective way to protect your family from the uncertainty of premature death. It can help assure that a preselected amount of money will be on hand to replace your income and help your family members — your children and your spouse — maintain their standard of living. With life insurance, you can select an amount that will help your family meet living expenses, pay the mortgage, and even provide a college fund for your children. Best of all, life insurance proceeds are generally not taxable as income.

Keep in mind, though, that the cost and availability of life insurance depend on factors such as age, health, and the type and amount of insurance purchased. We typically recommend term life insurance which covers you for a fixed period (i.e., 10, 20, or 30 years), is designed to protect your dependents in case you die prematurely and is cheaper than other life insurance policies (i.e., whole life).

We also recommend you check with your employer who may offer group-term life insurance coverage (typically $50,000 per employee). If your employer provides in excess of $50,000, the excess amount must be included in your income and is subject to Social Security and Medicare taxes.2

Consider purchasing disability income insurance

If you become disabled and unable to work, disability income insurance can pay benefits — a specific percentage of your income — so you can continue meeting your financial obligations until you are back on your feet. Short-term disability insurance is sometimes provided through your workplace, either as a mandatory or voluntary benefit. For more flexible and comprehensive protection, consider buying disability income insurance.

What about Social Security? If you do become permanently and totally disabled and are unable to do work of any kind, you may be eligible for benefits, but qualifying isn’t easy.3

Start building a college fund now

According to the College Board, for the 2019/2020 school year, the average cost of one year at a four-year public college is $21,950 (for in-state students), while the average cost for one year at a four-year private college is $49,870 (the total cost of attendance includes tuition and fees and room and board). Even if those numbers don’t go up (and they are expected to continue increasing), that would come to $87,800 for a four-year degree at a public college, and $199,480 at a private university.4 Oh, and don’t forget graduate school.

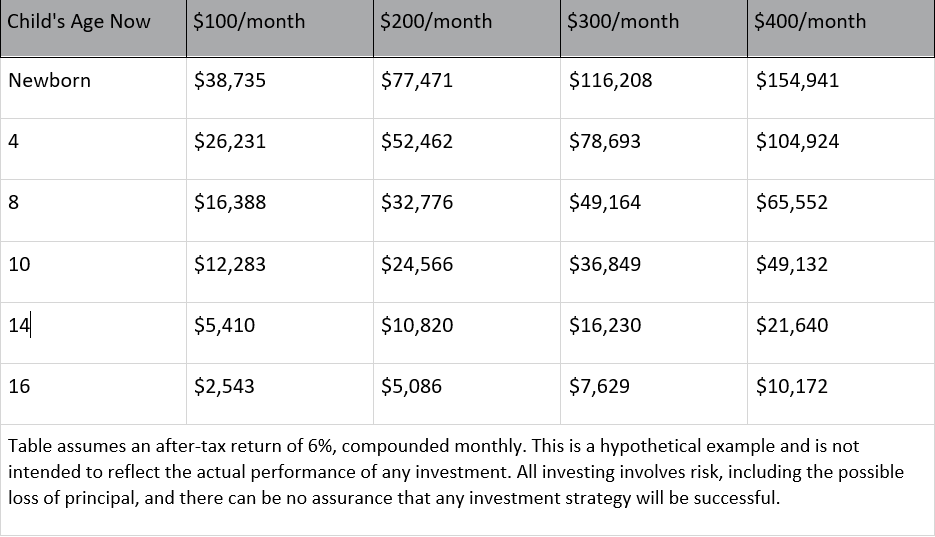

College costs may seem daunting, especially if you’re still paying off your own college loans, but you have about 18 years before your newborn will be a college freshman. By starting today, you can help your children become debt-free college grads. The secret is to save a little each month, take advantage of compound interest, and have a sum waiting for you when your child is ready for college.

The following chart shows how much money might be available for college when your child turns 18 if you save a certain amount each month.

Keep saving for retirement

Many well-intentioned parents put saving for retirement on hold while they save for their children’s college education. But if you do so, you’re potentially sacrificing your own financial well-being. If you postpone saving for retirement, you might miss out on years of tax-deferred growth, and it may be hard to catch up later.

Ideally, you’ll want to save regularly for both goals. but if you have limited funds, prioritize saving for retirement. Your child may receive financial aid to pay for college, but there’s no such option for you.

- Source: Expenditures on Children by Families, 2015, released January 2017.

- Source: IRS Publication 15-B (https://www.irs.gov/government-entities/federal-state-local-governments/group-term-life-insurance).

- Source: Social Security (https://www.ssa.gov/disability/).

- Source: College Board, “Trends in College Pricing 2019”, November 2019 (https://research.collegeboard.org/pdf/trends-college-pricing-2019-full-report.pdf).

Prepared by Broadridge Investor Communication Solutions, Inc. Copyright 2020