When it comes to effective estate planning and wealth transfer strategies, Grantor Retained Annuity Trusts (GRATs) stand out as one of the best tools. They were popularized by the Walton family (best known for founding the retailers Walmart and Sam’s Club) as a way to get around owing the IRS millions in taxes. This strategy has been used by many other notable individuals like Phil Knight, the founder of Nike. You do not need to be a billionaire to get the same benefits!

A GRAT is an irrevocable trust into which an individual places an asset with the expectation that it will grow in value. In exchange for putting assets into the trust, the individual receives annuity payments for a specified number of years. At the end of that term, any assets left in the trust (typically the appreciated value) are transferred to the beneficiaries (like your children) tax-free.

Think of a GRAT like a special box where you put an asset (e.g., stocks, real estate, or other investments). This asset might be worth a certain amount today, but you believe it will be worth more in the future. The GRAT allows you to benefit from the asset’s growth while minimizing potential gift or estate taxes.

How does a GRAT work?

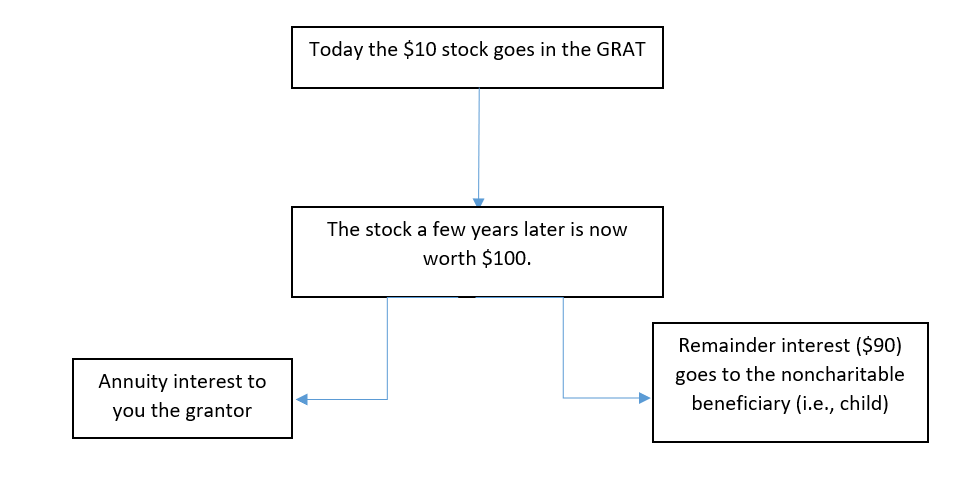

Imagine that a stock is like a Luke Skywalker action figure toy that’s worth $10 today, but you think it’ll be worth $100 in a few years.1 You want to give this stock (toy) to your child in the future, but if you wait until it’s worth $100, you might have to pay a big gift tax. So, you use a GRAT:

1. You (the grantor) put the toy (stock) in a special box (the GRAT) and say that for the next few years, the toy will pay you back a little bit of its value each year. This “payback” is called an annuity. The annuity can be a stated dollar amount, fixed fraction, or a percentage of the initial fair market value of the property transferred to the GRAT.

2. If, at the end of those few years, the toy has grown in value more than you expected, everything extra (the remainder interest) goes to your child without any gift tax. *The value of the remainder interest is determined by subtracting the present value of the expected future annuity payments from the fair market value of the original transfer to the GRAT.

3. If the toy doesn’t grow in value, or if it’s worth less, that’s okay! You just got your annuity payments, and the toy goes back to you, so you’re still able to play with the toy after it spent its time in the GRAT.

Example:

Why Use a GRAT?

1. Tax Efficiency – When setting up a GRAT, the value of the gift is reduced by the annuity payments you’ll receive. If the assets grow more than expected, the excess growth passes to your beneficiaries free of gift tax.

2. If the assets don’t appreciate as much as you hoped, no worries. The assets just revert to you with no adverse gift-tax consequences.

3. Asset Protection – Assets in the GRAT are generally protected from creditors.

A Few Things to Remember:

- Timing is Essential – GRATs work best in low-interest-rate environments because the assets in the GRAT only need to outperform the IRS’s set interest rate (often referred to as the “Section 7520 rate”) to provide a benefit.

- Risk – If the grantor (the person who set up the GRAT) dies during the trust term, most or all of the trust assets may be included in their estate for tax purposes. Hence, it’s essential to select an appropriate trust term.

- Legal Counsel – Setting up a GRAT involves specific legal processes and paperwork. Always consult with an attorney or financial planner familiar with GRATs and your personal financial situation.

GRATs offer a unique avenue for individuals to pass on appreciating assets to beneficiaries in a tax-efficient manner. Like all financial strategies, it’s vital to understand the ins and outs and seek expert advice tailored to your needs. Remember, as with all financial decisions, it’s always wise to consult with a trusted financial advisor or attorney to ensure that a GRAT is right for your specific situation.

- A 1978 Luke Skywalker figurine sold for $25,000 in 2015 as part of a $500,000 Star Wars collection at Sotheby’s.

Disclosure: BFSG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to BFSG’s website or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please remember that different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy (including those undertaken or recommended by Company), will be profitable or equal any historical performance level(s). Please see important disclosure information here.