It is readily apparent that the Federal Reserve (the “Fed”) is more focused on employment rather than inflation. Last year the Fed released a new policy framework (1) that included a shift away from its traditional practice of raising interest rates based on the headline unemployment rate (U-3). It used to be that the market was trained to expect rate increases being triggered by the achievement of full or maximum employment, a level below which economists generally think inflation bubbles up in true Phillips Curve fashion. (2)

In Fed Chairman Jerome Powell’s appearance before the Senate Finance Committee last week he expanded on the Fed’s employment objective to what he called a “broad-based and inclusive goal,” where officials consider the unemployment rate of minorities as well as workers who are more marginally attached to the labor market. (3)

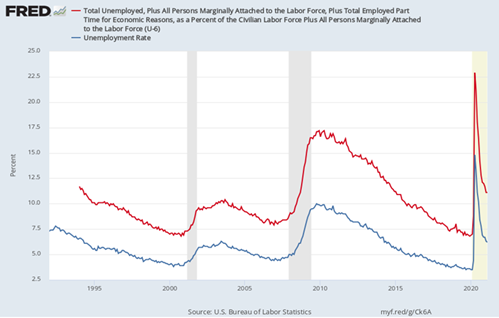

So, investors should no longer be focused on the “official” rate of unemployment, the U-3 rate. Instead, the Fed appears to be more concerned with the U-6 rate, which stands at 11.1% (versus a 6.2% U-3 rate). The African American unemployment rate, meanwhile, is 9.9%, while the Hispanic unemployment rate is 8.5%.(4) How the Fed is weighing these measures and where it wants them to be is unclear, as discussions have been qualitative not quantitative.

But it does dovetail with the Fed’s “patient” attitude towards inflation. The U-6 unemployment rate is historically “sticky” on the downside as skills training for marginal and disadvantaged workers takes time before meaningful employment occurs (see the chart above). It remains a huge policy question whether “structural” unemployment can be remedied by monetary policy. We have our doubts and keeps us very uneasy about the Fed’s response to cyclical inflation with their reaction function geared to the U-6.

- See Federal Open Market Committee (2020b, 2020e, 2020f).

- The Phillips curve is an economic concept developed by A. W. Phillips stating that inflation and unemployment have a stable and inverse relationship. The theory claims that with economic growth comes inflation, which in turn should lead to more jobs and less unemployment. Read more here about the relevance of the Phillips curve to modern economies.

- The Bureau of Labor Statistics (BLS) defines marginally attached workers as persons who are not in the labor force, want and are available for work, and had looked for a job sometime in the prior 12 months. They are not counted as unemployed because they had not searched for work in the prior 4 weeks, for any reason whatsoever. The marginally attached are a group that includes discouraged workers.

- Source: BLS, Civilian Unemployment Rate (https://www.bls.gov/charts/employment-situation/civilian-unemployment-rate.htm#)

Disclosure: BFSG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to BFSG’s web site or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please see important disclosure information here.