By: Henry VanBuskirk, CFP®, Wealth Manager

One of the most crucial financial planning topics that almost nobody likes to talk about is life insurance. In our line of work, it’s akin to discussing politics or religion. Don’t worry, I’m not going to discuss politics or religion here. There are enough outlets online that proselytize on those topics already and you are free to find your preachers of choice there. Life insurance is an uncomfortable topic to discuss because it bluntly asks the question “If you die unexpectedly, will your surviving family members that depend on you financially be able to financially support themselves?”. The general reaction I get when I bring up this planning topic to clients who don’t have life insurance or are unsure if they need it is usually a grimace followed by one of three responses:

- “It’s something on our to-do list.”

- “I probably wouldn’t qualify because of my health.”

- “It’s too expensive.”

These responses are, in my opinion, the result of natural mental barriers that a person puts up to not have to think about what happens to their loved ones after they die. Most people generally know that life insurance is important to discuss but don’t want to discuss it now.

- “Is there a need?”

- “If there is a need, how much coverage do you need and how long do you need that coverage for?”

It follows that if there is a need, it’s important to understand the different types of life insurance available and what coverage can be appropriate for you based on your unique situation. Life insurance can be broken down into two categories, cash value life insurance, and term life insurance. Some of the key differences are summarized below:

Term Life Insurance is life insurance that has a death benefit that is guaranteed only for a predetermined period of time, normally 10, 20, or 30 years and will continue as long as premiums continue to be paid. Some term life insurance has a conversion option that allows the policy to be converted to a Whole Life Insurance policy with a reduced death benefit if the insurance needs to continue past the original predetermined period of time. Typically, Term Life Insurance is the least expensive form of life insurance.

Cash Value Life Insurance is life insurance that offers a death benefit to the insured beneficiaries and has a cash value component. The cash value component can either have its growth guaranteed, have its growth tied to an underlying market index, or have its growth tied to the performance of investment subaccounts that are invested in the stock and bond markets. There are many types of policies available, such as Whole Life Insurance, Universal Life Insurance, Variable Universal Life Insurance, Guaranteed Universal Life Insurance, etc. but the common thread between all of these types of cash value life insurance policies is that they all have a cash value component in addition to a death benefit. The death benefit can be stated guaranteed amount until a certain age or have variability in the death benefit and how long that death benefit will be available depending on the investment or index performance of the cash value component. Typically, the Whole Life Insurance policy is the most expensive since the death benefit is guaranteed to be available until the insured reaches age 120 as long as premiums continue to be paid in the policy. On the other hand, Variable Universal Life Insurance is the least expensive form of cash value life insurance since there is variability in the death benefit amount, the amount and frequency premiums can be paid, and how long the death benefit is good for. The cash value can be accessed in the form of a policy loan or as withdrawals. The cash value is normally subjected to a surrender charge that can be on the contract for 10-20 years depending on the type of cash value life insurance and the insurance company offering that policy.

From a 30,000-foot view, a person’s life insurance needs are as follows:

After you have established if you have a need, now we need to determine what the most appropriate type of life insurance policy is for you. One popular saying that you may have heard is ‘Buy Term and Invest the Difference’. The argument for ‘Buy Term and Invest the Difference’ is that you will have more funds to give to your heirs if you take the money that you would have used to purchase a Cash Value Life Insurance policy to instead buy some term insurance and invest the remaining premium amount into a nonqualified investment account. Life insurance death benefits are normally tax-free to beneficiaries and the heirs to a nonqualified investment account would generally receive a step-up in cost basis at the original account owner’s death. The step-up in cost basis would mean that the heirs would receive the investment account proceeds tax-free. The argument against ‘Buy Term and Invest the Difference’ is that you would need to take on market risk in order to meet your goals that a Cash Value Life Insurance policy could have guaranteed. To illustrate the potential benefit of ‘Buy Term and Invest the Difference’, we have the following case study.

Case Study

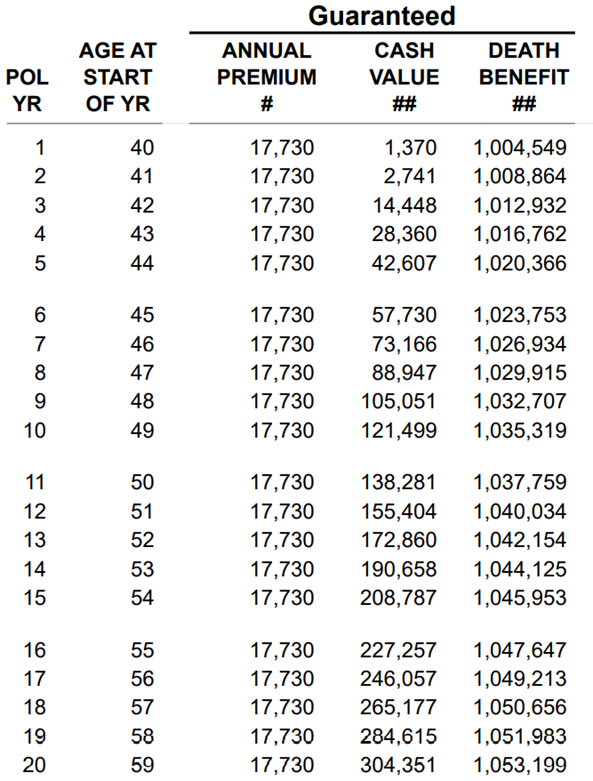

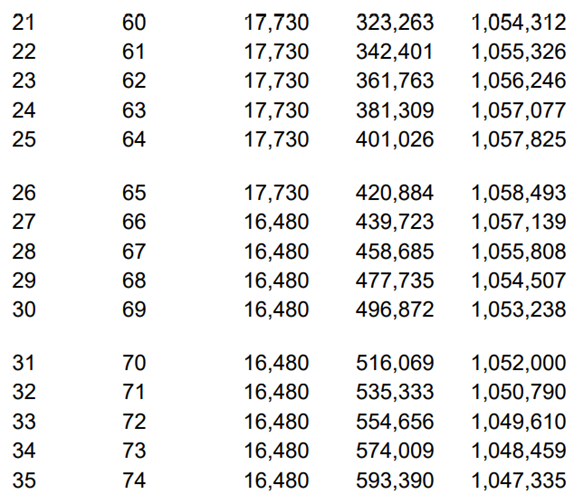

Melvin Kaminsky (age 40) had a comprehensive financial plan done for him by his financial planner, Mr. Wilder. Mr. Wilder determined that Melvin needed life insurance. Melvin is in good health and has four young children with his wife, Anne, who is a homemaker. Melvin makes a good living as an independent filmmaker and will retire at age 60. Melvin will need $1 million of coverage to make sure that the $300,000 mortgage on his home will be paid off and that Anne will have sufficient funds available to care for the kids until the kids reach adulthood. It was determined that a 20-year term life insurance policy would be sufficient coverage for them. Melvin appreciated Mr. Wilder’s work and decided to his financial plan to another advisor, Mr. Salesman. Mr. Salesman recommends that Melvin purchase Whole Life Insurance instead. To understand the costs associated with that recommendation, Melvin asked for an illustration to be run. Here is a summary of that Whole Life Insurance illustration:

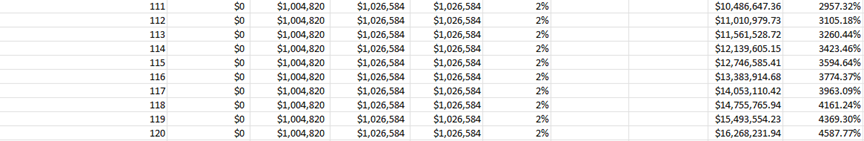

Melvin looks at the policy and notices that he would have to pay $17,730 each year through ages 40-65 and $16,480 per year through ages 66-98 and no further premiums after age 99 to guarantee a death benefit of $1 million. That would be a possible total cost of $1,004,820.

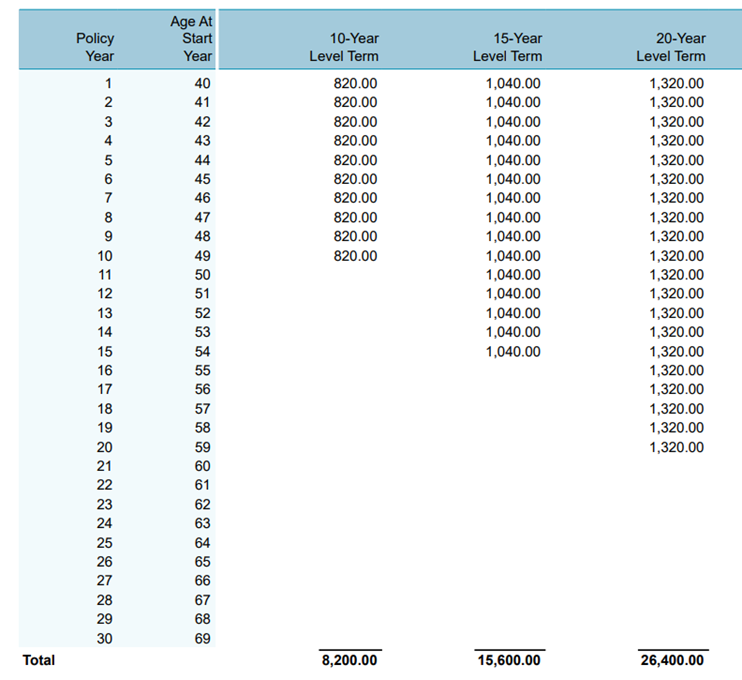

Melvin is wary of this high projected cost and decides to show Mr. Salesman the Term Life Insurance illustration that his financial planner, Mr. Wilder, ran. Here is a summary of that Term Life Insurance illustration:

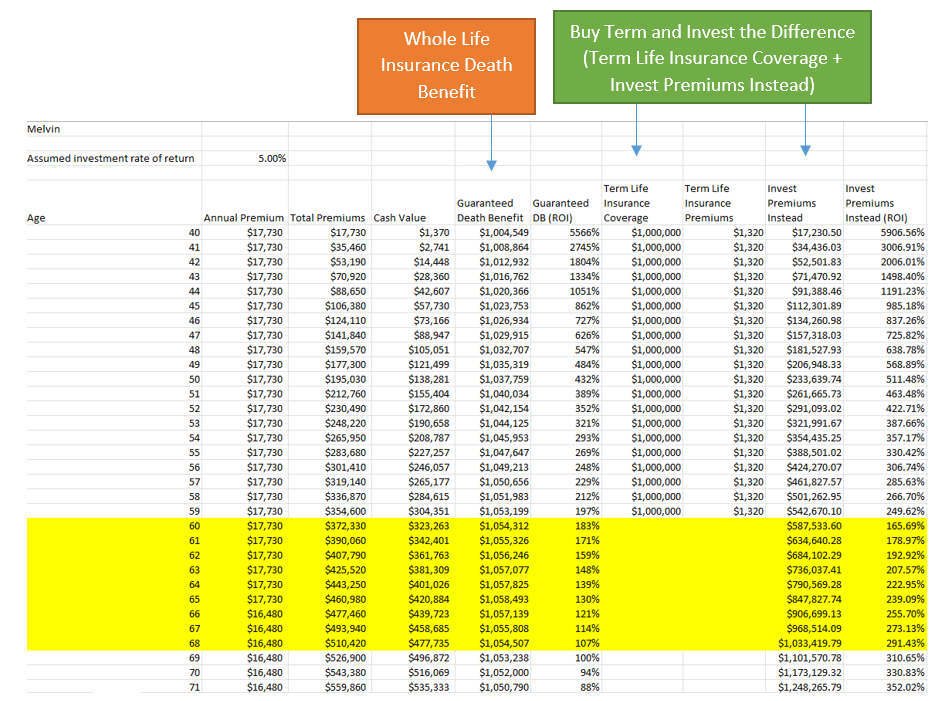

Melvin compares the two policies and asks Mr. Salesman, “The costs in the first 20 years for this Whole Life Insurance policy for me would be $354,600, while the 20-year term life insurance cost over the 20 years would be $26,400. Why would I purchase the Whole Life Insurance policy if I only need coverage for 20 years?”. The advisor, Mr. Salesman, explains, “20 years is a long way away and your needs may change. Your kids may need money to make sure their college is paid for if you pass away after 20 years, you may purchase a different home and take on a new mortgage larger than your current one, or you may want to make sure your kids receive an inheritance in the form of a guaranteed death benefit.” Melvin remembers hearing about ‘Buying Term and Investing the Difference’ and asks Mr. Salesman about it. Mr. Salesman balks at the idea and says that it’s hogwash. Melvin decides to meet with his financial planner, Mr. Wilder since he might know about ‘Buying Term and Investing the Difference’. Melvin decides to meet with Mr. Wilder and Mr. Wilder runs a scenario where the difference in premiums is invested in a nonqualified investment account that earns a net after-tax return of 5% per year. The following is a summary of that analysis.1

Melvin reviews the numbers and asks Mr. Wilder why he highlighted the section between Melvin’s ages 60-68. They have the following conversation:

Mr. Wilder: “This is the point in time where a whole life insurance policy could potentially offer more of a death benefit than the ‘Buy Term and Invest the Difference’ strategy could for you, assuming a 5% net after-tax rate of return on the investment account.”

Mr. Wilder continues: “As I noted in your financial plan, you only need insurance coverage for 20 years. I also believe that the added cash flow flexibility you would have by not purchasing a Whole Life Insurance policy would help you during your primary working years and emergencies that may come up as you raise your children. Plus, investing will receive a step-up in cost basis upon your death and your children will most likely be inheriting more money. If you are risk-averse and want to make sure a death benefit is available for your children regardless of how long you live or how the stock market performs, the Whole Life Policy could put your mind at ease at the cost of up to an additional $978,420 throughout your lifetime.

Melvin makes note of the fact the $978,420 is very close to $1,000,000 and gets upset, thinking about Mr. Salesman’s pitch to him about purchasing Whole Life Insurance. Their conversation continues:

Melvin: “Why would Mr. Salesman pitch Whole Life Insurance to me? Why would anybody purchase Cash Value Life Insurance?”

Mr. Wilder: “There are legitimate reasons why someone would recommend a Cash Value life insurance policy. For example, if an ex-spouse receives alimony payments and is younger than the person paying the alimony, a Cash Value Life Insurance policy can be structured to make sure payments can continue regardless of how long the alimony payer lives. Another example would be for an owner looking to reduce total estate tax liability by removing a life insurance policy from the owner’s estate. In any case, I don’t believe that a Cash Value Life Insurance policy is appropriate for you.”

Melvin: “Well it wasn’t appropriate for me, so why would Mr. Salesman recommend Whole Life Insurance?”

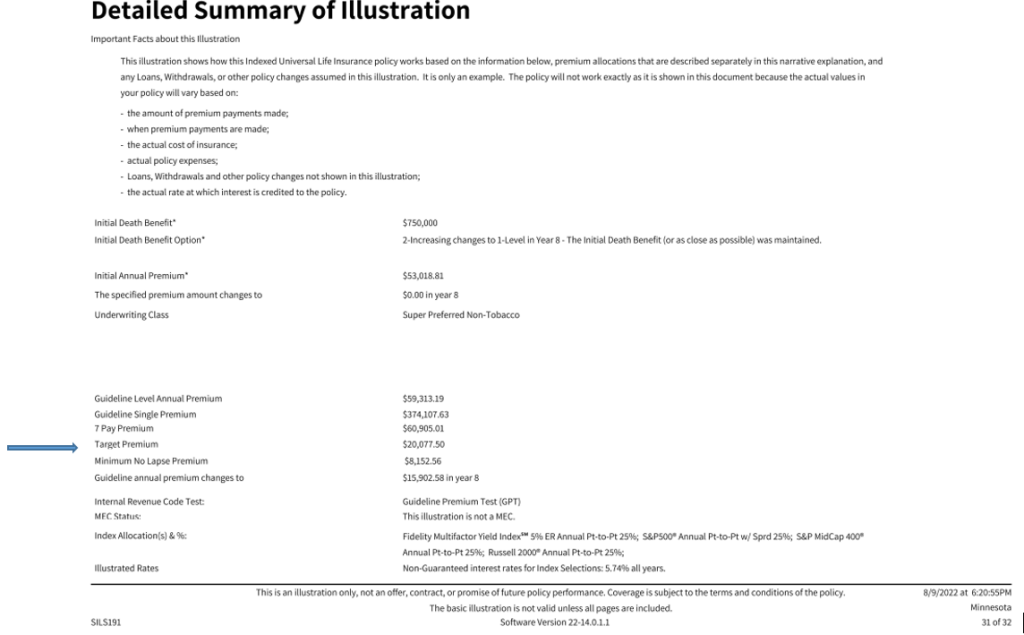

Mr. Wilder: “Not to make any judgments on a person’s character, but ironically a hint could be in his last name. Candidly, insurance agents don’t make much on term life insurance. In your case, he probably would be making $40. Take for example a cash value life insurance policy I came across from another client.”

Mr. Wilder: “See the column for target premium for $20,077.50? That’s how much the insurance agent can make on the policy before the broker the insurance agent works for takes their cut. The insurance agent probably gets around half. $10,000 is not a bad payday for selling one policy. The death benefit in that example was $750,000 is also less than what you were quoted, so Mr. Salesman would have made at least $10,000 on you if you went with his recommendation.”

Melvin: “I see. The oldest motivator there is. You know, Gene, you didn’t have to explain the money part of this, but I’m glad you did. Why did you explain this by the way? Don’t you want to sell me insurance?”

Gene: “I am a fee-only financial planner and I believe that to avoid conflicts of interest, it is best for the client that I don’t receive commissions for sales of products of any kind so that I can focus solely on the appropriate recommendation for the client. I will refer you to an insurance provider that can write the Term Life Insurance policy for you.”

Melvin: “Sounds good. Please let me know what I need to do on my end. As a thank you, I’m working on a movie called The Producers and I think you would be a good fit for one of the main characters2. I know you’ve started dabbling into acting recently, you might catch your big break.”

Gene: “I’m flattered by the offer, but I’m not sure if I’m ready for a major role in a feature film yet.”

Melvin: “Don’t worry, I think you’ll be great.”

Gene: “I’ll read through the script and get back to you.”

Melvin: “I’ll need a decision soon, Gene. Let me know what you think. Thank you for your help with the life insurance questions.”

Gene: “You’re welcome. I’ll get back to you soon3.”

Conclusion:

My Grandpa always used to say, “Life Insurance is a bet against yourself.” While there’s some truth to that, no one is immortal. However, there are ways you can stack the cards in your favor, or there are strategies that you could implement to make sure the house wins in the end. The great thing about doing a comprehensive financial plan is that you’ll know exactly how many chips you need and how to bet before you sit down at a table in the “Life Insurance Casino”. The important questions to ask yourself before any life insurance is purchased are:

- Do I need life insurance?

- If so, how much life insurance coverage do I need, and how long do I need it for?

- How is the person recommending the life insurance to me being compensated and how much are they being compensated for?

To distance ourselves from conflicts of interest, BFSG does not sell annuities or life insurance. BFSG does not sell any product, nor do we receive any compensation from any source other than our clients. This helps us strive to always put our clients’ interests first and remain objective.

Our goal is to make the uncomfortable conversation of life insurance, comfortable. If you are in need of a comprehensive financial plan, life insurance needs analysis, or a current life insurance policy review, please feel free to give us a call at 714-282-1566 or email us at financialplanning@bfsg.com to get the conversation started.

Footnotes:

- A detailed analysis of the assumptions used in the analysis can be made available upon request.

- The reference here is to the movie, The Producers (1967): https://www.imdb.com/title/tt0063462/. There is a 2005 remake of the same name (The Producers (2005): https://www.imdb.com/title/tt0395251/) starring Matthew Broderick and Nathan Lane that is a decent movie in its own right. However, if you only have time for one of the films, just watch the original 1967 film.

- Gene did read the script and decided to star in Mel Brooks’ (Melvin Kaminsky) seminal film The Producers (1967). It helped catapult Gene’s and Mel’s careers and both went on to act in, produce, write, and/or direct many other films together. Gene decided to outsource his financial planning business to BFSG since BFSG is also a fee-only financial planning firm that doesn’t receive commissions for sales of products of any kind.

Disclosure: BFSG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to BFSG’s website or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please remember that different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy (including those undertaken or recommended by Company), will be profitable or equal any historical performance level(s). Please see important disclosure information here.