Christmas came early this year for the markets. The idea that falling inflation could mean that the end to the rate hiking cycle is not far off gave both stocks and bonds a boost.

Here are 3 things you need to know:

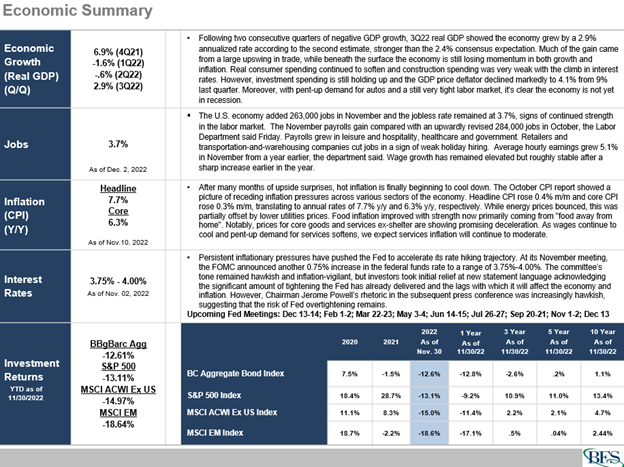

- The October consumer price index (CPI) showed prices rose 7.7% from a year ago and 0.4% from the prior month, according to the Labor Department, both below expectations. Prices of goods and autos fell, as supply chain disruptions continued to ease. Food, services, and shelter inflation were stickier.

- Long-term U.S. Treasuries returned +7% in November, their biggest monthly gain since August 2019. Global bonds as measured by the Global Aggregate Bond index, rebounded in November (+4.7%), adding a record $2.8 trillion in market value.

- Not all assets were in recovery mode in November. The US Dollar Index saw its worst monthly performance in over a decade (-5%). Bitcoin fell (-16%) as investors withdrew $20 billion from crypto funds in November.

Sources:

- Sources: J.P. Morgan Asset Management – Economic Update; Bureau of Economic Analysis (www.bea.gov); Bureau of Labor Statistics (www.bls.gov); Federal Open Market Committee (www.federalreserve.gov); Bloomberg; FactSet; Goldman Sachs Asset Management.; John Hancock Investment Management.

- Indices:

- The Bloomberg Barclays Aggregate Bond Index is a broad-based index used as a proxy for the U.S. bond market. Total return quoted.

- The S&P 500 is designed to be a leading indicator of U.S. equities and is commonly used as a proxy for the U.S. stock market. Price return quoted.

- The MSCI ACWI ex-US Index captures large and mid-cap representation across 22 of 23 developed market countries (excluding the U.S.) and 27 emerging market countries. The index covers approximately 85% of the global equity opportunity set outside the U.S. Price return quoted.

- The MSCI Emerging Markets Index captures large and mid-cap segments in 26 emerging markets. Price return quoted (USD).

Disclosure: BFSG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to BFSG’s website or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please remember that different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy (including those undertaken or recommended by Company), will be profitable or equal any historical performance level(s). Please see important disclosure information here.