August kicked off with some market turmoil and any hopes of a late summer lull were quickly dashed. However, by month end, the market had rebounded as investors began to price in more aggressive policy easing by the Federal Reserve (Fed). Here are 3 things you need to know:

- The S&P 500 was up for the 4th month in a row (+2.4% in total return terms). The Magnificent 7 continued to be a drag, falling -0.4% and losing ground for a second straight month.

- U.S. Treasuries were up +1.3% in total return terms, which was a 4th consecutive monthly gain.

- Gold was up +2.3% for the month, exceeding $2,500/oz for the first time.

*The seven mega-cap stocks, also referred to as the “Magnificent Seven”, are Microsoft (MSFT), Apple (AAPL), Alphabet (GOOGL), Amazon (AMZN), Nvidia (NVDA), Meta Platforms (META), and Tesla (TSLA).

Sources: J.P. Morgan Asset Management – Economic Update; Bureau of Economic Analysis (www.bea.gov); Bureau of Labor Statistics (www.bls.gov); Federal Open Market Committee (www.federalreserve.gov); Bloomberg; FactSet.

Indices:

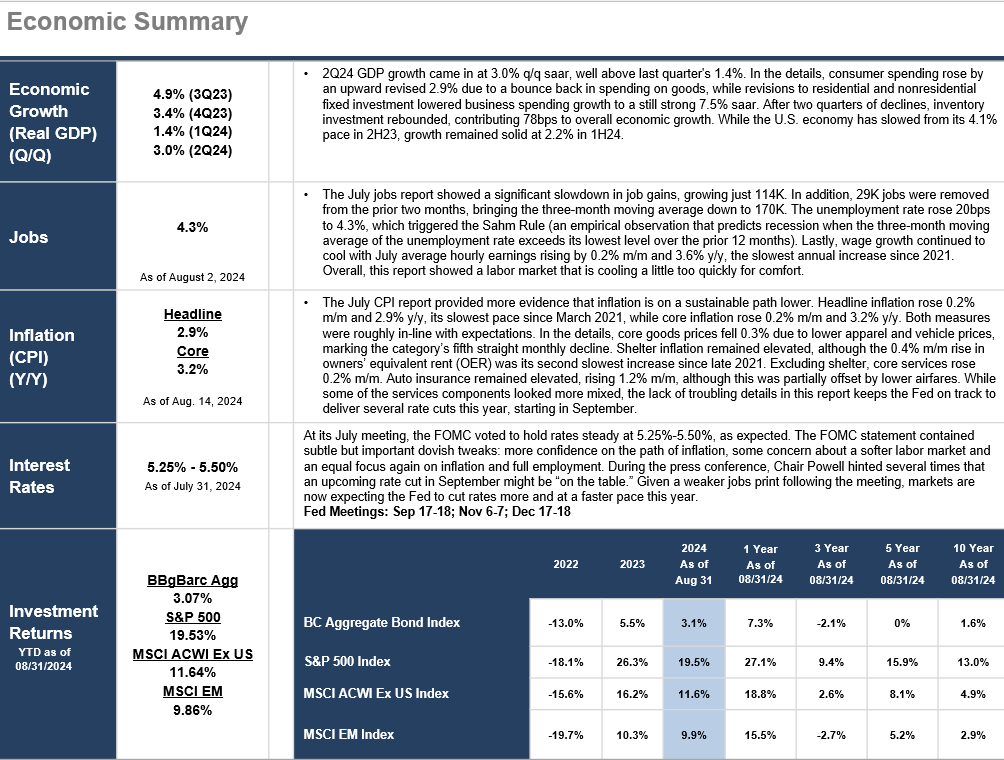

- The Bloomberg Barclays Aggregate Bond Index is a broad-based index used as a proxy for the U.S. bond market. Total return quoted.

- The S&P 500 is designed to be a leading indicator of U.S. equities and is commonly used as a proxy for the U.S. stock market. Price return quoted.

- The Russell 2000 Index is a small-cap U.S. stock market index that makes up the smallest 2,000 stocks in the Russell Index.

- The MSCI ACWI ex-US Index captures large and mid-cap representation across 22 of 23 developed market countries (excluding the U.S.) and 27 emerging market countries. The index covers approximately 85% of the global equity opportunity set outside the U.S. Price return quoted.

- The MSCI Emerging Markets Index captures large and mid-cap segments in 26 emerging markets. Price return quoted (USD).

Disclosure: BFSG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to BFSG’s website or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please remember that different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy (including those undertaken or recommended by Company), will be profitable or equal any historical performance level(s). Please see important disclosure information here.