By: Paul Horn, CFP®, CPWA®, Senior Financial Planner

I am under the firm belief that as long as the IRS exists, we have job security. Trying to understand and interpret the IRS feels akin to reading hieroglyphics with no formal training. Often the IRS will create a new rule, but it generally takes time for them to interpret and clarify the ruling. We have seen this occur with rules around how individuals are required to take money out of inherited retirement accounts (i.e., IRA or 401k).

The IRS recently released Notice 2022-53 that provides guidance relative to certain required minimum distribution (RMD) rules enacted by the Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019. The notice also announced that the Department of the Treasury and the IRS will issue final RMD regulations effective no earlier than the 2023 distribution calendar year which, to date, have not been released in final form.

Once the final RMD regulations are effective, these changes will impact many individuals starting in 2023.

Elimination of the “Stretch IRA”

Before 2020, individuals that inherited a retirement account like an IRA or 401(k) had to take RMDs each year based on their life expectancy. This ability to spread out taxable distributions after the death of an IRA owner or retirement plan participant, over what was potentially such a long period of time, was often referred to as the “stretch IRA” rule. The SECURE Act of 2019 changed the rules for those that inherited IRAs and required that the money be taken out within ten years of the date of death of the original account owner. Many professionals assumed this meant that no money was required to be taken out of the inherited retirement accounts from 2020 until the 10th year. Until recently, the IRS did not provide any guidance for inherited retirement account RMDs.

What Will Change

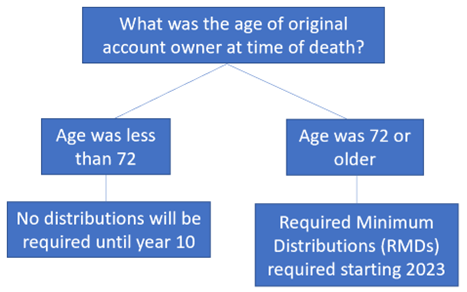

Starting in 2023, under new IRS guidance, owners of inherited accounts may be required to take an RMD from their inherited IRA depending on the age of the original owner at the date of their death. For example, Lauren inherited an IRA from her mother who was 73 years old when she passed away in 2021. Starting in 2023, Lauren will be required to make distributions from the inherited IRA based on her life expectancy. Since the IRS has not provided any past guidance, there will not be any requirements or penalties for not making distributions in 2021 or 2022. Below is a flow chart to help understand if you need to start distributions from the inherited retirement accounts.

What Needs to Be Done Starting 2023

If you have an inherited IRA or inherited retirement plan that was opened 2020 or later, you will need to review if the original account owner was 72 or older when he/she passed away. If they were 72 or older you will be required to begin to take distributions. Speak with your advisor or custodian (i.e., Schwab or Fidelity) in early 2023 to learn more about how much you will need to withdraw to be compliant with the new IRS guidelines.

Disclosure: BFSG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to BFSG’s website or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please remember that different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy (including those undertaken or recommended by Company), will be profitable or equal any historical performance level(s). Please see important disclosure information here.