(This is the third article in a four-part series. Click here to read Part 1 and Part 2.)

By: Henry VanBuskirk, CFP®, Wealth Manager

Mr. Hill arrived in Texas and is eager to talk to his parents about the Roth Conversion idea that he overheard his boss talking about at work last week. Mr. Hill does not know his parents’ finances and just believes that a Roth Conversion will be a good idea for them and for anyone else their age. This is important to understand that while the recommendations that we give are not gospel, there are very few universal financial planning recommendations that can be given. We will show throughout this article why it is important to go through the financial planning discovery process to understand the household’s unique needs, what assets they have to work with, and how realistic their financial goals are before making a Roth Conversion recommendation.

As Mr. Hill heard over the phone, a Roth Conversion is when someone takes funds from an IRA, pays taxes on the distributed amount, and transfers the distributed amount into a Roth IRA. As long as the person is over age 59.5 and waits 5 years before taking money from the Roth IRA, distributions are tax-free. Mr. Hill knows that his parents do not have an advisor and do all of their financial planning work themselves on their financial planning software. Mr. Hill then proceeds to call his parents and they decide to run the numbers. Here is a summary of their financial plan (which we will call the Base Case):

- Hank and Peggy are 68, live in Texas, and are projected to live to age 100.

- Hank and Peggy are retired, but Hank still works part-time at Strickland Propane earning $5,000 per year. Hank plans to work part-time until age 70.

- Peggy earns a pension of $25,000 per year that grows at 2% per year and will pay out throughout both of their lives1.

- Hank will receive $46,000 per year in Social Security benefits starting at age 70. Peggy does not receive any Social Security benefits.

- They have $25,000 in cash earning 1.55% per year.

- Hank has an IRA worth $102,000 earning 4.66% per year.

- Peggy has an IRA worth $87,000 earning 4.66% per year.

- Their home is worth $480,000 and there is no debt on the property. The home value is expected to appreciate by 2.5% per year.

- $3,000 per year for Alamo Beer, indexed to inflation at 2.5%

- $30,000 every 10 years to buy a new truck starting in 2025, indexed to inflation at 2.5%

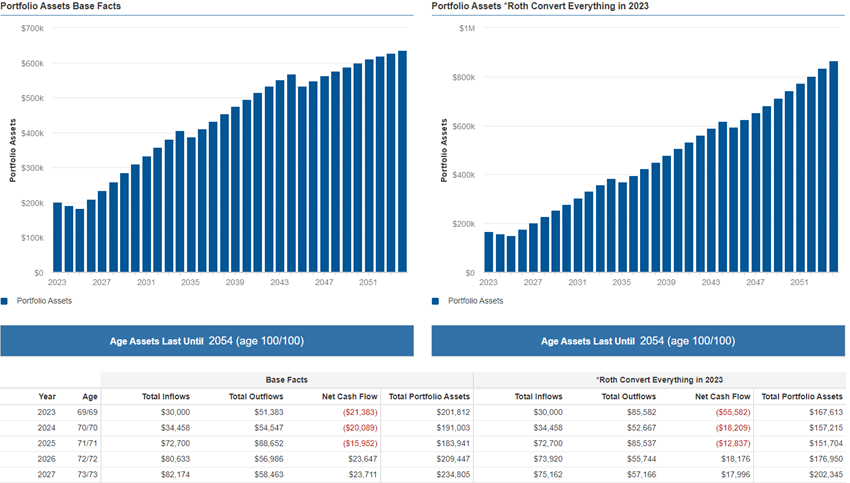

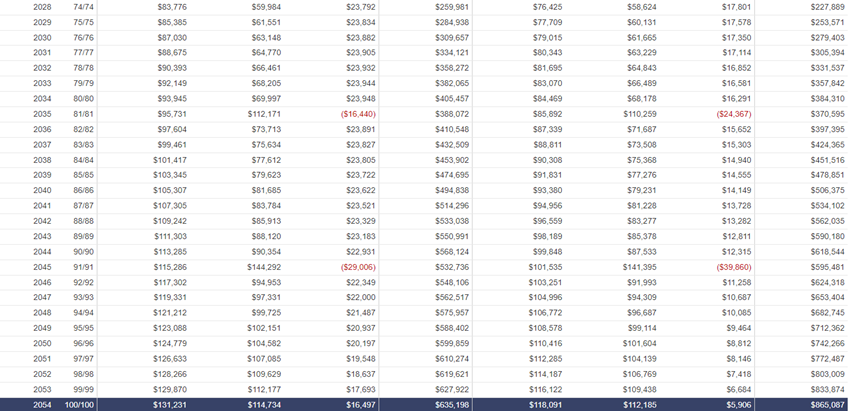

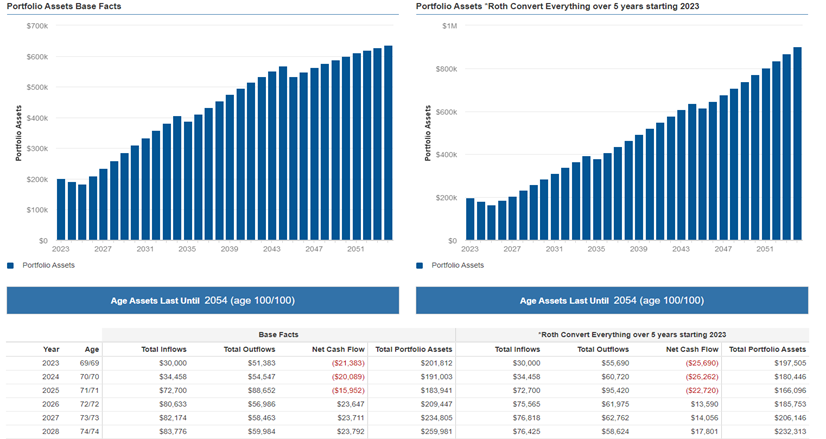

Hank and Peggy want to see the effect of converting both of their IRAs to Roth IRAs. They run the numbers and get the following result:

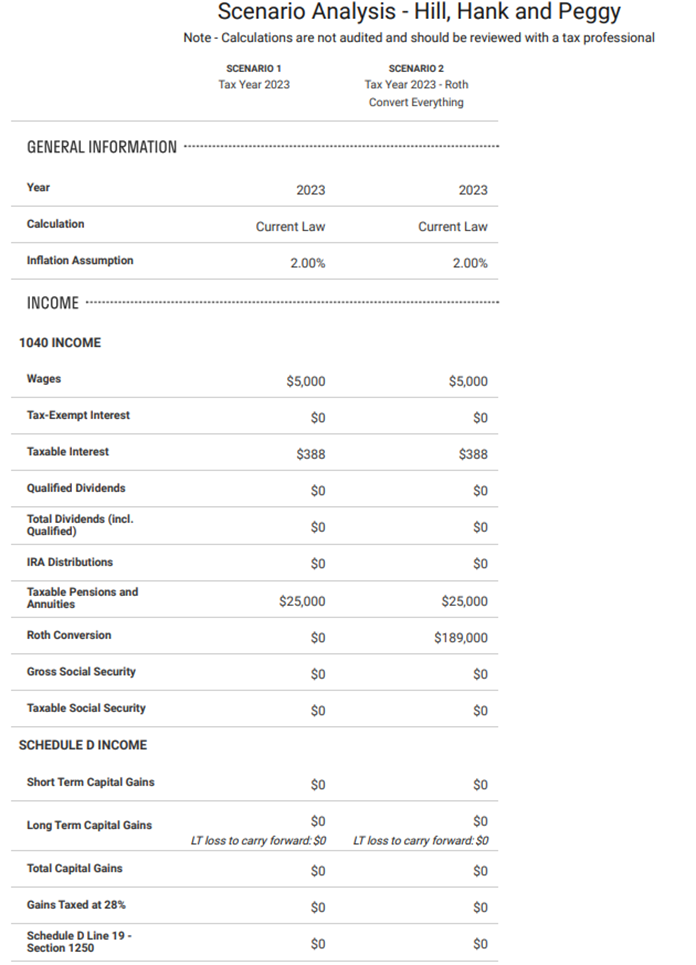

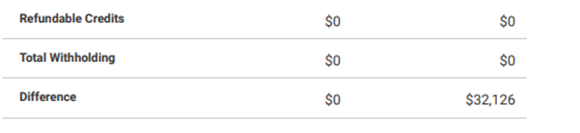

Hank and Peggy are pleased to see that their total assets are $229,889 greater ($865,087 vs. $635,198) at age 100 by doing the Roth Conversion this year. Hank and Peggy understand that by doing a Roth Conversion, they would be treating any amount that they convert from their IRA as ordinary income in the year of the conversion. Therefore, they run the scenario in their tax planning software and get the following result:

Hank and Peggy like what they see and understand that they can pay $32,126 in taxes this year to have an additional $229,889 at the end of their financial plan since they will not be required to take any RMDs (Required Minimum Distributions) during their lifetimes. Hank and Peggy decide to meet with a local advisor, Mr. Handshake that checks their work and commends them for their plan. Mr. Handshake mentions that they have no problem with their planning. The advisor thanks Hank and Peggy for their time and the meeting concludes. Hank has an uneasy feeling about Mr. Handshake since his handshake was not firm. Hank mentions this uneasy feeling to Peggy about Mr. Handshake’s handshake and says he can’t trust a person who doesn’t have a firm handshake. Peggy rolls her eyes and then obliges Hank’s concern and decides to schedule a meeting with another advisor, Mr. Rock, to get a second opinion.

Mr. Rock meets with Hank and Peggy to review their financial plan and their Roth Conversion scenario. He mentions that while their assumptions are correct, there are a couple of items that he wants to make sure that they are aware of. Hank has been listening intently the entire meeting since Mr. Rock’s handshake at the onset of the meeting was very firm. They have the following conversation:

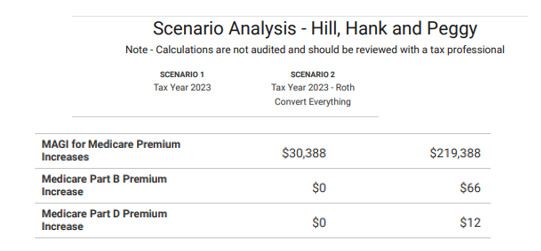

Mr. Rock: “Hank, Peggy, your plan for a Roth Conversion does help out your financial plan in the long run, but it looks like you missed projections for the Medicare Part B and Part D increase when doing a Roth Conversion. I took the liberty of adding a couple of line items to your report:

Mr. Rock: “If you are going to do the Roth Conversion, you are going to need to pay in 2025 an additional $66 per month in Medicare Part B premiums and $12 in Medicare Part D premiums. This threshold that you passed is called IRMAA and was created to help fund the Medicare program2. What if I showed you a financial plan that would allow you to convert your IRAs to Roth IRAs over a 5-year period, increase your ending portfolio value by $36,136, and not have to worry about any increase in Medicare Part B or Part D premiums?

Hank and Peggy: “We’re listening.”

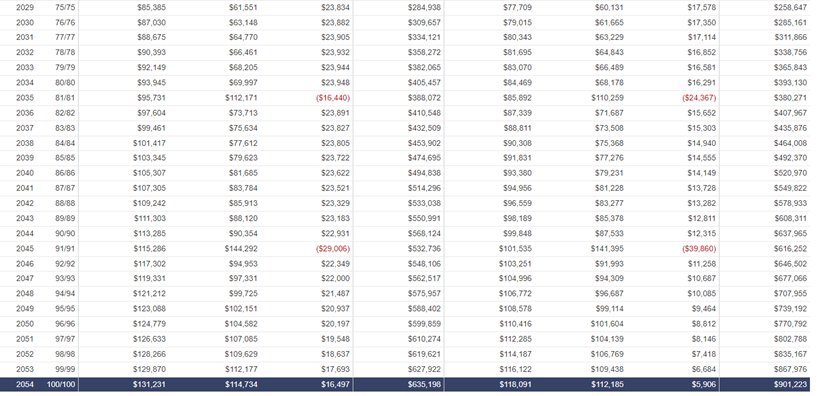

Mr. Rock: “First off, here is your updated plan with the new strategy for converting your IRAs to Roth IRAs over a 5-year period.

“As you can see, instead of a portfolio ending value of $865,087 from converting everything in 2023, you can instead have a portfolio ending value of $901,223 from the 5-year Roth Conversion strategy.”

Peggy: “Mr. Rock, hold on. I’m reviewing your tax planning projections for the 5-year Roth Conversion strategy and our plan to Roth convert everything in a 5-year period (for those interested in the calculations and assumptions used, please see the Appendix at the end of this article). Just so we understand correctly if we follow the 5-year Roth Conversion plan we would pay the following taxes:

- $4,059 in 2023

- $4,161 in 2024

- $8,971 in 2025

- $8,507 in 2026

- $9,511 in 2027

For a total tax of $35,209

and if we were to instead Roth convert everything in 2023, we would pay the following taxes if we were to Roth convert everything in 2023:

- $32,126 in 2023

- $0 in 2024

- $1,483 in 2025

- $572 in 2026

- $642 in 2027

For a total tax of $34,823

Why would we do the 5-year Roth Conversion plan if we would be projected to pay more in taxes?”

Mr. Rock: “You are right that you would pay more in taxes to the IRS over the next 5 years if you decided to do a Roth Conversion over the next 5 years instead of Roth convert everything in 2023, but you would also avoid any increase in Medicare Part B and Part D premiums by doing the Roth Conversion over a 5-year period. If you did Roth convert everything at once, you would owe an additional $936 in Medicare Part B and Part D premiums, which is the IRMAA discussion that I had with you earlier. You actually would owe less out of pocket over your lifetimes over the 5-year Roth Conversion plan and since you would be spreading that tax liability over a 5-year period, there is less strain on your portfolio and won’t need to withdraw as much in 2023, which leads to a higher ending portfolio value doing the 5-year Roth Conversion plan.”

Hank: “Can you explain that again?”

Mr. Rock: “Think of IRMAA as a tax, just one that is administered by the Social Security Administration, not the IRS. A tax in my book is any money that you need to pay from your earnings to a government entity to receive services from that government entity. Paying additional money each month for Medicare services whether or not you actually use those services is still money out of your pocket. Breaking down Peggy’s numbers from earlier, your total tax bill looks like this:

- 5-year Roth Conversion plan:

- $4,059 in 2023

- $4,161 in 2024

- $8,971 in 2025

- $8,507 in 2026

- $9,511 in 2027

For a total tax of $35,209

- Roth convert everything plan:

- $32,126 in 2023 + $936 IRMAA increase due in 2025 = $33,062

- $0 in 2024

- $1,483 in 2025

- $572 in 2026

- $642 in 2027

For a total tax of $35,759

You save $550 over this 5-year period by avoiding any Medicare Part B and Part D increases, increase your ending portfolio value by $36,136, and avoid RMDs during your lifetimes since all of your IRA assets would be in Roth IRAs by the time you reach your RMD age of 73.”

Hank: “That sounds great to me. What do you think Peggy?”

Peggy: “Sounds great to me. Thank you, Mr. Rock.”

Hank: “Thank you, Mr. Rock.”

Mr. Rock: “You’re welcome. Have a good day.”

Hank and Peggy decide to follow Mr. Rock’s advice and decide to have Mr. Rock manage their finances. There’s only one additional mistake that Hank and Peggy made. They didn’t ask how Mr. Rock was compensated. Luckily, Mr. Rock is a fee-only advisor, and his full title is Mr. Dwayne Rock, CFP®. A CFP® professional has a fiduciary duty, meaning that they strive to put their client’s interest ahead of their own at all times. Further, to be called a fee-only advisor, the advisor must adhere to the following rules (by the CFP Board’s definition)3: (a) the CFP® professional and the CFP® professional’s firm receive no sales-related compensation; and (b) related parties receive no sales-related compensation in connection with any professional services the CFP® professional or the CFP® professional’s firm provides to the client. It is important to note that just because an advisor can earn commissions, doesn’t make them nefarious. However, it is important to know how an advisor gets paid to understand whether or not they actually do have your best interest in their heart at all times when making a recommendation4. Tune in next week to see what potential issues can arise if you work with an advisor that puts their bank account ahead of your needs.

Footnotes:

- This pension benefit was awarded to her for winning “Substitute Teacher of the Year” three years in a row.

- You can find the IRMAA brackets here https://www.medicareadvantage.com/costs/medicare-irmaa

- https://www.cfp.net/-/media/files/cfp-board/standards-and-ethics/compliance-resources/cfp-board-guidance-for-fee-only-advisors.pdf

- BFSG is a fee-only Registered Investment Advisor.

Appendix:

Assumptions used in the tax calculations in the 5-year Roth Conversion plan:

- The pension income increases by 2% compounded interest each year

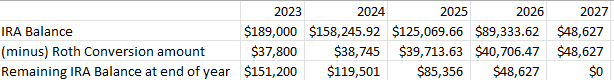

- The assumed values of the IRA values and the Roth Conversion amounts assume that Hank and Peggy’s IRA balances total $189,000 and increase by 4.66% per year. The Roth Conversion amount increases by 2.5% per year until the final year has the full remaining balance of $48,627.15 in Traditional IRAs be converted into their Roth IRAs. Here is the balance in a spreadsheet:

- Hank’s wages increase by 2.5% per year and stop at 2025

- Taxable interest increases by 1.55% per year

- Social Security starts in 2025 and increases by 1.5% per year

- The standard deduction does not sunset back to the proposed 2017 values (adjusted for inflation)

Assumptions used in the ‘Roth convert everything’ plan:

- The pension income increases by 2% compounded interest each year

- The entire combined IRA balance of $189,000 is converted into Roth IRAs in 2023

- Hank’s wages increase by 2.5% per year and stop at 2025

- Taxable interest increases by 1.55% per year

- Social Security starts in 2025 and increases by 1.5% per year

- The standard deduction does not sunset back to the proposed 2017 values (adjusted for inflation)

Disclosures:

Past performance is no guarantee of future results. Different types of investments involve varying degrees of risk. Therefore, there can be no assurance that the future performance of any specific investment or investment strategy (including the investments and/or investment strategies recommended and/or undertaken by Benefit Financial Services Group [“BFSG”]), or any consulting services, will be profitable, equal any historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. BFSG is neither a law firm, nor a certified public accounting firm, and no portion of its services should be construed as legal or accounting advice. Moreover, you should not assume that any discussion or information contained in this document serves as the receipt of, or as a substitute for, personalized investment advice from BFSG. A copy of our current written disclosure Brochure discussing our advisory services and fees is available upon request or at www.bfsg.com. The scope of the services to be provided depends upon the needs and requests of the client and the terms of the engagement. Please see important disclosure information here.

Please Note: The above projections are based upon historical data and should not be construed or relied upon as an absolute probability that a different result (positive or negative) cannot or will not occur. To the contrary, different results could occur at any specific point in time or over any specific time period. The purpose of the projections is to provide a guideline to help determine which scenario best meets the client’s current and/or current anticipated financial situation and investment objectives, with the understanding that either is subject to change, in which event the client should immediately notify BFSG so that the above analysis can be repeated.