As wildfires in California become more frequent and intense, considering the need for wildfire insurance has never been more important. For homeowners and residents in high-risk areas, understanding how this insurance works is crucial to safeguarding your real estate investment and for peace of mind.

The Basics

Most standard homeowner’s insurance policies include coverage for fire damage, including damages from wildfires. However, it’s crucial to verify damage from wildfires is covered, as it’s not always the case, particularly in areas highly susceptible to wildfires. When you apply for a home insurance policy, insurers charge for coverage according to the level of risk they assume by taking you on as a policyholder. Because of this, some insurance carriers will charge higher premiums, increase deductibles, cap payouts, or deny coverage altogether for homes in high-risk regions.

The Coverage

A typical wildfire insurance policy covers the structure of the home, personal belongings inside the home, additional structures on the property like sheds or detached garages, and loss of use or additional living expenses incurred if you’re forced to vacate your home due to a wildfire.

However, insurance policies can vary greatly, so it’s important to understand what’s covered and what’s not. For example, some policies may not cover additional living expenses, or they may have a limit on personal property coverage. Some may also exclude coverage for smoke damage, which can be a significant issue even if your home isn’t directly affected by the flames.

The California Landscape

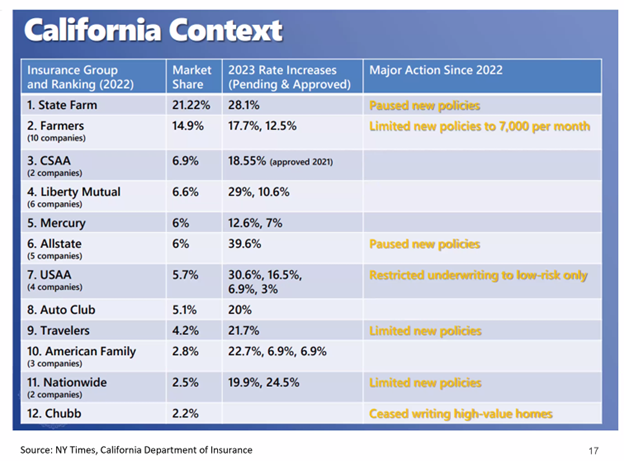

California’s unique geographic landscape and increasing drought conditions have resulted in a higher frequency of wildfires. These factors have also led to a significant shift in the insurance market. Some insurance companies have even stopped offering coverage in areas most at risk, leaving many homeowners looking for alternatives. Admitted carriers like Allstate and State Farm are leaving the state because reinsurance companies are increasing rates too fast and insurance companies can’t get the California Department of Insurance to raise rates fast enough (see chart below).1 Apparently, Californians aren’t “In Good Hands” anymore with Allstate, and “Like an Elusive Neighbor, State Farm isn’t there” (for Californians).

The Fair Access to Insurance Requirements (FAIR) Plan

Fortunately, in California, there is the Fair Access to Insurance Requirements (FAIR) Plan. The FAIR Plan is a state-mandated insurance pool designed to provide basic fire insurance coverage for homeowners who have been unable to obtain coverage through the traditional market. Enrollments have jumped in recent years to 272,846 homes in 2022.2 However, it’s important to note that the FAIR Plan should be seen as a last resort as the coverage is basic and may not fully cover all aspects of potential damage. For instance, the FAIR Plan does not currently offer personal property or replacement cost dwelling coverage types. Additionally, the plan will not cover:

- Houses with existing damage that have no repair plans

- Long-term vacant or unoccupied homes

- Properties used for federally illicit means

It is important to consider a Difference in Conditions (DIC) insurance policy that is designed to fill in the gaps of the perils not covered by the FAIR Plan. In addition, FAIR Plan policies are capped at $3 million for all coverages combined.

What Are the Options for Homes Over $3M

For coverage higher than $3 million, most insurance brokers are layering insurance with the FAIR Plan covering the first $3 million and then obtaining homeowners insurance through a surplus or excess line carrier. These insurers provide coverage for homes that carriers through the standard marketplace won’t take on as clients. Surplus lines do not abide by the same state regulations that standard carriers do, making them more expensive than the average homeowners insurance policy.

Prevention and Mitigation

Alongside insurance, it’s also critical to focus on wildfire prevention and mitigation efforts. This includes creating a defensible space around your property, using fire-resistant landscaping and building materials, and having an emergency evacuation plan in place. New home builders are beginning to use better materials for fire prevention.

Improve the insurability of your home by focusing on fire prevention. Some of the best ways to do this include home hardening (closed eaves, fiber cement board siding, dual-pane tempered screen windows, removing wood around the house), creating a defensible space (100-150 ft.), using exterior wildfire sprinkler systems, and removing highly flammable plants like Bougainvillea.

Insurance companies are increasingly recognizing these efforts and are offering discounts or incentives to homeowners who take active steps to protect their properties. Some companies are even working with homeowners, offering resources and guidance to make their homes more resistant to wildfires.

Conclusion

Successful financial plans must consider both wealth accumulation and wealth preservation. Wildfire insurance in California is not just a policy to protect your property; you’re protecting peace of mind. It is, essentially, a line of defense that helps you rebuild and recover in the aftermath of a wildfire. However, it’s also a complex product that demands understanding and mindfulness about its terms and conditions.

We want to ensure that you have adequate coverage, help you understand your insurance policy’s limitations, and sort through your insurance options so you can make better informed decisions. Our team can help with annual policy reviews, so before renewing an existing policy, Talk with Us!

Sources:

- Christopher, B., & Gedye, G. (2023, May 31). State Farm won’t sell New Home Insurance in California. Can the state shore up the market? CalMatters. https://calmatters.org/housing/2023/05/state-farm-california-insurance/

- Blood, M. R. (2023, June 5). California insurance market rattled by withdrawal of major companies. AP News. https://apnews.com/article/california-wildfire-insurance-e31bef0ed7eeddcde096a5b8f2c1768f

Disclosure: BFSG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to BFSG’s website or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please remember that different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment or investment strategy (including those undertaken or recommended by Company), will be profitable or equal any historical performance level(s). Please see important disclosure information here.