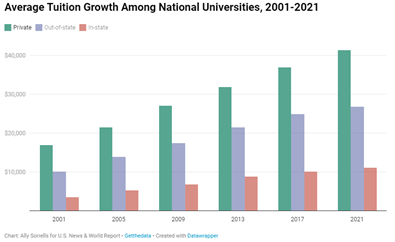

For many families, saving for kids’ education has become a priority and for a good reason. The average tuition for the 2021 school year ranged from approximately $11,000 (for in-state colleges) to over $41,000 (for private colleges)1. That is approximately 2.5 times what the cost was in the early 2000s, so it would be fair to expect this cost to be substantially higher in the future.

For those parents who are eager to start saving for college, BFSG’s Certified Financial Planners™ often recommend 529 accounts. A 529 account is a tax-advantaged savings plan designed to encourage savings for future education expenses.2 However, some parents are reluctant to open a 529 account because they are afraid their children may not be able to take advantage of financial aid. This is not entirely true and with the right planning, 529 accounts generally have a marginal impact on the amount of aid you receive.

529 accounts owned by a parent are considered a parent asset for Free Application for Federal Student Aid (FAFSA). The first $10,000 of a 529 account is excluded from FAFSA and only 5.64% of the account’s value beyond that amount will impact a student’s financial aid package. Therefore, this is a small negative impact considering the potential tax-free investment gains that are expected from a 529 account. In addition, the earnings and withdrawals of a parent-owned 529 account will not be reported on FASFA.

On the other hand, 529 accounts owned by relatives such as grandparents are subject to different rules. The account value is not counted as an asset on the FAFSA form as it would for a custodial parent but the withdrawals from the 529 account will be considered non-taxable income for the student and up to 50% of the value of the withdrawal could impact financial aid. For example, if a grandparent pays the private school tuition of $41,000 from a 529 account, that amount may reduce financial aid by as much as $20,500! However, there are effective strategies that can be incorporated to minimize this impact on financial aid eligibility. Please reach out to your financial advisor at BFSG to find the best strategy for your circumstances.

In short, for a typical family, kids’ college education expenses can be the second most expensive investment after a purchase of a home. A 529 account is an effective and useful tool to help you invest and pay for your kids’ education with minimal impact to financial aid eligibility. It is important to invest early to take advantage of tax-free compounding gains and incorporate a strategy to maximize your financial aid package.

Check out our webinar “A Definitive Guide for Education Planning” to learn about the best ways to save for college.

1. Source: 20 Years of college expense (https://www.usnews.com/education/best-colleges/paying-for-college/articles/2017-09-20/see-20-years-of-tuition-growth-at-national-universities)

2. U.S. Securities and Exchange Commission, “An Introduction to 529 Plans” (https://www.sec.gov/reportspubs/investor-publications/investorpubsintro529htm.html#:~:text=A%20529%20plan%20is%20a,of%20the%20Internal%20Revenue%20Code)

Disclosure: BFSG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to BFSG’s web site or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please see important disclosure information here.