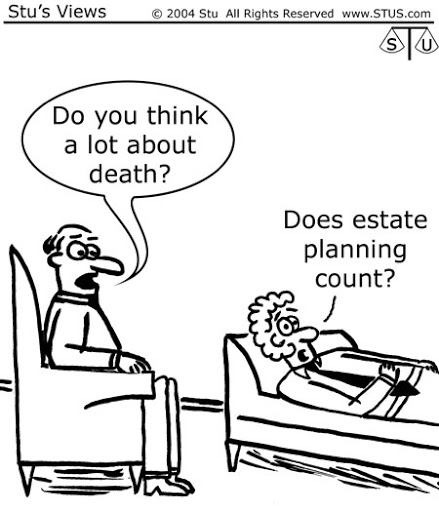

As CERTIFIED FINANCIAL PLANNER™ professionals, we get to discuss everyone’s two favorite topics, death and taxes. The reality is that no one wants to discuss their death and this is the greatest hurdle to overcome and the reason so many people do not have an estate plan. Below are some other common roadblocks that can reduce the quality of your estate plan.

1. Not Discussing Finances with Your Heirs

Some interesting studies have shown inherited wealth typically does not make it past the first generation of heirs. The wealth that does make it and is passed to several generations have one common trait, the heirs were well prepared to handle the inheritance properly. The reason for this is the parents did a great job of communicating and teaching the proper values to their kids. This does not mean telling them everything they will receive but instead communicating your values and wishes for them to follow.

2. Thinking This Will Never Happen To Me

It is human nature to see something happen to a friend or on the news and think that could never happen to me. Many individuals do not want to consider their mortality and instead live with a feeling of invincibility. This trait is most common in men for sure but it can impact anyone. Delaying your estate plan is a recipe for disaster and this is a common reason why this occurs.

3. Deciding Who Gets What and How Much

Family dynamics are difficult to navigate, even for the closest of families. As you begin the process, uncomfortable truths will begin to emerge and are difficult to navigate. Who gets family heirlooms? Are there items that have strong emotional ties to you or heirs? The best way to get started is to make a list and start with the easiest assets and slowly work your way down.

4. Not Clearly Defining Your Goals or Objectives.

As you develop the estate plan, it is important to clearly define how you want to leave your legacy. Is there an alma mater or charity you want to leave money to? Do you have a child with substance abuse problems and how do you leave money to them in a way that doesn’t fuel their addiction? If you have a child that is well off and another that is struggling financially do you not split the assets evenly? How do you protect your kids from themselves, their potential ex-spouses, or creditors? It is important to have an estate plan that navigates difficult issues by clearly stating how your estate is to be handled in those circumstances.

5. Paying For and Working With An Attorney

People seem to have a fear of working with an attorney, just like many people have a fear of going to the doctor. Nobody sees an attorney for the fun of it and many people dread the topics discussed and also the seriousness of the topic typically begins to creep in. The other part of this is everyone knows working with an attorney is not cheap. While creating a good estate plan is not cheap, it will pay for itself tenfold by reducing hassles and costs for your estate when the documents are finally needed.

We also recommend you watch the replay of our Summer Webinar Series “Estate and Legacy Planning” which discusses estate planning basics, the documents you will need, and common estate plan designs.