Fiduciary Consulting Services

Which model do you prefer?

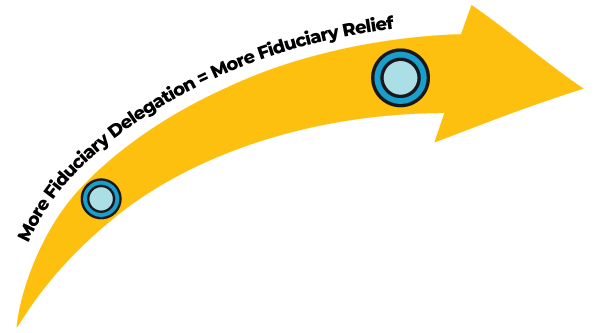

ERISA Section 3(21) Co-Fiduciary Advisor

Consultant provides Plan Sponsor advice in a fiduciary capacity for a fee.

Plan Sponsor maintains overall discretion and functions as the prudent expert in approving the investment menu

Plan Sponsor assumes co-fiduciary liability in the decision-making process.

ERISA Section 3(38) Discretionary Investment Manager

Plan Sponsor delegates authority to consultant decisions regarding the plan’s investment options

Plan Sponsor’s duties shift to monitoring the prudent expert; the investment consultant.

Delegation must be made in writing.

Who is a fiduciary?

- Have any discretionary authority or responsibility in the administration of the plan;

- Exercise any discretionary authority or control over the management of the plan’s assets; or

- Render investment advice for a fee or other compensation, direct or indirect, with respect to any moneys or other property of the plan, or have any authority or responsibility to do so.

- Please keep in mind that fiduciary status is generally determined based on a person’s function or duties as opposed to his or her title.

Am I personally liable for the plan’s investment decisions?

- If you meet the definition of a fiduciary and have authority or control over the investment decisions of the plan, you are responsible for creating and maintaining a documented, prudent process to select, monitor and update investments that are appropriate for the plan. If you fail to do this, you may be personally liable for losses due to a breach of fiduciary responsibilities. The expected level of knowledge is that of a professional who has experience doing this kind of work. That’s why it is difficult for many plan sponsors to safely accomplish this on their own.

What is ERISA?

- ERISA stands for the Employee Retirement Income Security Act. It sets standards for most voluntarily established pension and health plans in private industry to provide protection for individuals in these plans. ERISA section 3(21) defines the term “fiduciary” and section 3(38) sets forth the requirements for serving as an “Investment Manager” to a qualified retirement plan.

Complimentary Fee Analysis and Investment Review

All we need is a copy of your 408(b)(2) Plan Sponsor Fee Disclosure and we will provide a report which benchmarks fees and investment performance against industry averages.